I do not understand how people can actually treat what is effectively a permanent cut in spending (same pound of flesh every year for the next ten years) as fiscal responsibility in this environment.

Budget baselines are very frustrating things to deal with, but one thing should be clear: some kind of baseline is important to have. People like Paul Gregory (HT - Russ Roberts) are remarking on the fact that discretionary spending is still projected to increase $110 billion over the next decade despite the approximately trillion dollar cuts.

If someone told you NGDP was going to increase by over a trillion but in fact it's only going to increase by $110 billion would you say "no big deal - it's still growing!". No - you'd call that a depression.

For my younger readers I'm sure you're expecting real earnings growth throughout your career. You're not going to be earning your current salary forever. Think of your anticipated salary growth ten years from now. Now if you actually got only 10 percent of that growth, would you consider that a good thing? How would your plans change?

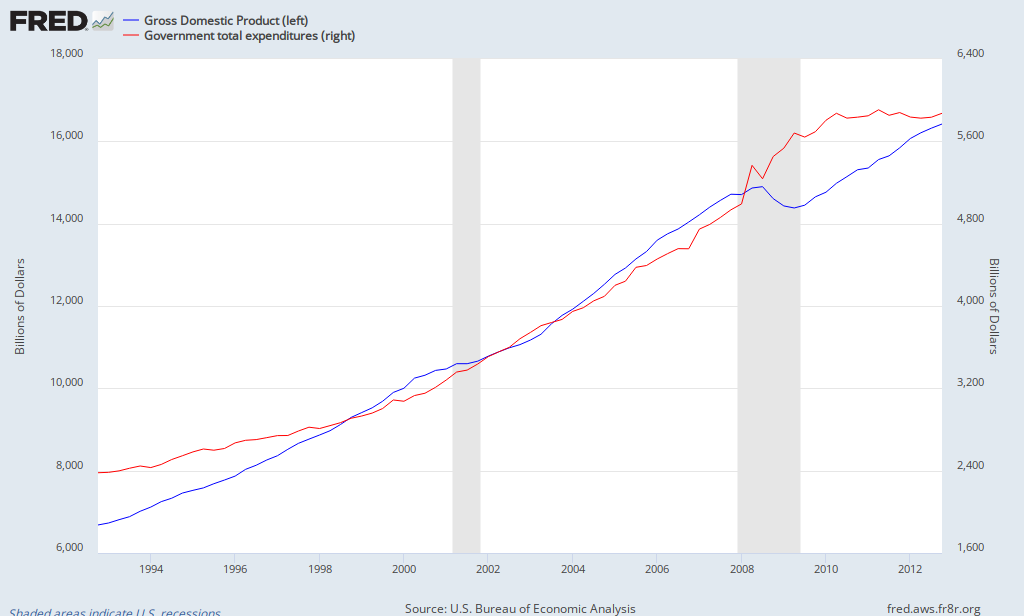

NGDP is badly off trend but it is growing (although last quarter was ominous). Government expenditure is effectively flat-lined.

If any other component of output did this people would recognize it for the problem that it is. If this were your salary you would recognize it for what it is. But when it's "other people's money", stupidity reigns.

Note that government expenditures don't have the persistent trend line that NGDP does. We can fiddle with it - I'm not saying that's off the table. Ironically the spending protected from the sequester (entitlements and direct war spending) is exactly where we have our spending problems that ought to be addressed. But the idea that now is the time to do it or this is the way to do it is ridiculous.

I don't see why the Fed can't make up for the sequester. Cranking up the printing press is not that hard. Especially when it's not even actually a printing press.

ReplyDeleteWell first and foremost is the problem that they aren't and members of the board who would like to are also saying that fiscal stimulus would make their lives a lot easier.

DeleteSecond, I lean your way but I don't think we can entirely discount problems posed by expectations traps and the limits of less conventional monetary policy. These claims are literally grounded on the fact that there is no upper bound to how much the Fed can print and that price/quantity split problems take care of themselves. Maybe. But I'd prefer a couple options.

Third (and maybe this should have been first), this is no way to run a government or determine how much the government should contribute to GDP. It doesn't even address the most problematic spending (entitlements and war spending).

I see your point on the fact that the Fed might not budge. And also that it would be better to cut judiciously rather than across the board. That said, if this is the only way we can get cuts on problematic budget lines, maybe this is worth it. And anyways, there is always time later to boost good programs but hopefully not the bad ones starting from a lower baseline.

DeleteBut on the macro side, I just want to see this happen so we can get some answers. I mean, the sequester is basically a random cut to government spending. It's going to be hard to find a better natural experiment. Yes, people might get hurt, but people also get hurt because we don't know these answers. A better understanding of macro could do a lot of good in the future.

Even if the FOMC does nothing (that is keep their short-term interest rate target which should mean shrinking the money supply, I think) we'll learn something useful and maybe more people will take AD shortfalls seriously.

That said, on a personal level, I'm not going to be happy if we dip again.

Because yes, a small ratcheting down of spending growth is a massive, existential threat to the Republic. It most surely is.

ReplyDeleteTreating the "components" of GDP as autonomous is part of the problem. Just because there's going to be a tiny "cut" in the rate of increase in government spending does not mean that aggregate activity production will fall. The people released from these jobs can (and must) go do something else productive (and likely more valuable to others).

ReplyDeleteThe other problem is that the old trend is now 5 years old. Are we to believe that the old path of wage expectations is stuck on that old trend line? Why? Why isn't it now the case that expectations have adjusted to the new, 5-years-running NGDP trend line? What if, as I tend to suspect, our current unemployment is now mostly if not entirely structural?

Moreover, isn't it the role of the economist to push for the right policy no matter what? If the monetary authority is the one who should rightly maintain nominal growth stability, it's not good enough to say "well, they're not doing it, so lets get on with wasting real resources via unsuccessful and theoretically dubious fiscal stimulus". No. Economists should all unite around pushing the Fed to do what is right. But wait... economists don't all agree, you say? In fact, they're all over the map on these issues, always have and likely always will be? Well, that's a challenging position for a discipline aiming for scientific rigor to reconcile. With such lack of consensus, I'd argue to go back to the basics. The government is wasteful. We spend WAY too much on the military by any rational metric. So cut it all. Waste is always bad. Always.

PS. If anything, this graph is a wonderful representation of just how little government expenditures actually impacts the path of nominal income, which is to say, it doesn't really at all.

ReplyDelete