As of right now I can only muster a modest discussion of the first two with passing references to the second two in this chapter for Guinevere Nell.

I wasn't even aware of Oi's work (a lot of it building on Hutt) until I did some googling after his death.

Tuesday, December 31, 2013

Sunday, December 29, 2013

Some links

- The Herndon, Ash, and Pollin response to Reinhart and Rogoff is going to be coming out in the Cambridge Journal of Economics, a fine publication if I do say so myself which focuses a lot on Keynesian, Post-Keynesian, and Classical economics.

- David Henderson has a nice tribute to Walter Oi, who passed away on Christmas Eve. David has written a lot on Oi's work on the all volunteer force and ending conscription. I've personally got a lot out of his work on labor as a quasi-fixed factor of production (it's sort of the starting point in the lit review of my apprenticeship chapter of my dissertation).

- Kitchens and Fishback have a new working paper on rural electrification.

- Hanushek et al. have a new working paper on variability in returns to skill across countries - variability is surprisingly high and current estimates underestimate the lifetime impact of skills.

- David Henderson has a nice tribute to Walter Oi, who passed away on Christmas Eve. David has written a lot on Oi's work on the all volunteer force and ending conscription. I've personally got a lot out of his work on labor as a quasi-fixed factor of production (it's sort of the starting point in the lit review of my apprenticeship chapter of my dissertation).

- Kitchens and Fishback have a new working paper on rural electrification.

- Hanushek et al. have a new working paper on variability in returns to skill across countries - variability is surprisingly high and current estimates underestimate the lifetime impact of skills.

Saturday, December 28, 2013

Super-duper inside Austrian baseball

There has been a recent spat on the intertubes between some people associated with the Ludwig von Mises Institute and some people associated with George Mason. In this matchup the Mises Institute people are supposed to be the boorish rubes and the George Mason people are supposed to be the serious academics.

In some ways, the stereotype makes sense. All Austrians are fairly political, but the Mises Institute people take it to a whole new level. Sometimes it's that they mix their ideology/political philosophy thinking in with their economics - and they take both seriously. Sometimes it's because they're not very serious and they just take breaks from their Ron Paul boosting and statist (i.e. - non anarcho-capitalist) bashing to talk about economics. There's a range in Auburn just like there is anywhere.

But what I think there George Mason crowd misses in many cases is that as far as scholarly engagement goes, for the most part they aren't especially distinguishable from Auburn. The biggest distinction is on the ideology front.

Painting in broad strokes, of course there are more firebreathers in terms of their actual ideas in Auburn, but the Auburn crowd has been nicer to me personally than the George Mason crowd.

If you look at their treatment of non-Austrians (particularly Keynesians), the George Mason crowd seems equally dismissive to me. They make idiotic or rude comments about Krugman or DeLong with equal frequency as far as I can tell that doesn't speak well to their commitment to "civil intellectual engagement". The public choice facets of the George Mason camp if anything make them more likely to attribute disagreement to bad faith or impure motives on the other side. And that gets old really fast.

As far as basic facts they seem to botch other ideas with equal frequency.

I'm reading Living Economics right now by Peter Boettke to review for Free Liberal, and while he has some great intellectual history in there he also has the EXACT same claims that we see all the time from internet Austrians.

You cannot convince me that Walter Block or Robert Wenzel are anymore less civil than a handful of GMUers (the usual suspects... I'm not going to name names, because UNLIKE Block and Wenzel some of these guys will actually throw a hissy fit if I name them). And of course there are gems too. Pete Boettke (the GMU axis) and Bob Murphy (the Mises Institute axis) are both guys I disagree with a lot but perfectly civil.

So as much as I like to see them beat each other up, there seems to be a huge presumption by a lot of people that it's just obvious that we should be more dismissive of the Mises Institute people than the GMU people. It seems to me that a lot of GMUers who might not realize it should hear from an outsider that the distinction is not as strong as they seem to think. And they should probably be more critical of their own bad actors.

In some ways, the stereotype makes sense. All Austrians are fairly political, but the Mises Institute people take it to a whole new level. Sometimes it's that they mix their ideology/political philosophy thinking in with their economics - and they take both seriously. Sometimes it's because they're not very serious and they just take breaks from their Ron Paul boosting and statist (i.e. - non anarcho-capitalist) bashing to talk about economics. There's a range in Auburn just like there is anywhere.

But what I think there George Mason crowd misses in many cases is that as far as scholarly engagement goes, for the most part they aren't especially distinguishable from Auburn. The biggest distinction is on the ideology front.

Painting in broad strokes, of course there are more firebreathers in terms of their actual ideas in Auburn, but the Auburn crowd has been nicer to me personally than the George Mason crowd.

If you look at their treatment of non-Austrians (particularly Keynesians), the George Mason crowd seems equally dismissive to me. They make idiotic or rude comments about Krugman or DeLong with equal frequency as far as I can tell that doesn't speak well to their commitment to "civil intellectual engagement". The public choice facets of the George Mason camp if anything make them more likely to attribute disagreement to bad faith or impure motives on the other side. And that gets old really fast.

As far as basic facts they seem to botch other ideas with equal frequency.

I'm reading Living Economics right now by Peter Boettke to review for Free Liberal, and while he has some great intellectual history in there he also has the EXACT same claims that we see all the time from internet Austrians.

You cannot convince me that Walter Block or Robert Wenzel are any

So as much as I like to see them beat each other up, there seems to be a huge presumption by a lot of people that it's just obvious that we should be more dismissive of the Mises Institute people than the GMU people. It seems to me that a lot of GMUers who might not realize it should hear from an outsider that the distinction is not as strong as they seem to think. And they should probably be more critical of their own bad actors.

Saturday, December 21, 2013

Tuesday, December 17, 2013

Sunday, December 15, 2013

Questions on James Buchanan

Does anyone know if he ever had any dealings with:

1. The Reagan administration

2. The Federalist Society

3. State politics (in Virginia or elsewhere)

4. Desegregation issues

1. The Reagan administration

2. The Federalist Society

3. State politics (in Virginia or elsewhere)

4. Desegregation issues

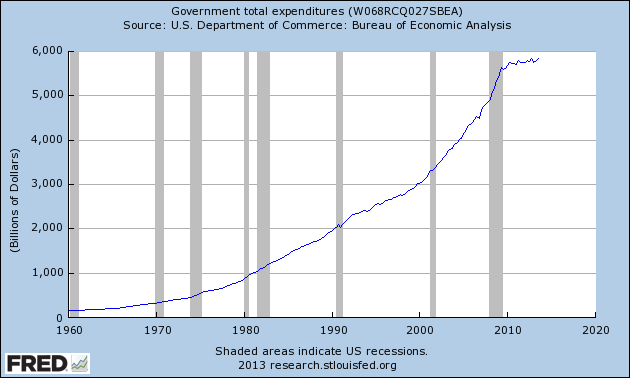

This is what austerity looks like...

And yet for some reason Bob Murphy thinks that this graph is proof AGAINST Krugman's concerns!

The post linked above is an excellent demonstration of the gaping chasm that exists between different peoples' interpretation of what's been going on. I sort of wish now I talked more about current events in my class. I talked about the evolution of growth theory and about the Lucas critique on the last two days of class, respectively, but I kind of wish I kept the Lucas critique and spent the other class period talking about the Great Recession and the policy response as they relate to Keynes and Hayek.

As it stands I was very skimpy on policy in the Hayek lecture and in the Keynes lectures. For Keynes we did an overview day, a day on consumption theory, a day on investment theory, and a day on interest rate theory - with some monetary policy discussion coming in on the interest rate theory day and a brief mention of fiscal stimulus on the consumption day when we derived the multiplier. Hayek didn't have any direct policy talk.

Perhaps this was a mistake.

This graph screams austerity but for some reason people are caught up on the fact that it did not actually decrease and ignoring the fact that the last five years look very, very different from the preceding fifty.

The post linked above is an excellent demonstration of the gaping chasm that exists between different peoples' interpretation of what's been going on. I sort of wish now I talked more about current events in my class. I talked about the evolution of growth theory and about the Lucas critique on the last two days of class, respectively, but I kind of wish I kept the Lucas critique and spent the other class period talking about the Great Recession and the policy response as they relate to Keynes and Hayek.

As it stands I was very skimpy on policy in the Hayek lecture and in the Keynes lectures. For Keynes we did an overview day, a day on consumption theory, a day on investment theory, and a day on interest rate theory - with some monetary policy discussion coming in on the interest rate theory day and a brief mention of fiscal stimulus on the consumption day when we derived the multiplier. Hayek didn't have any direct policy talk.

Perhaps this was a mistake.

This graph screams austerity but for some reason people are caught up on the fact that it did not actually decrease and ignoring the fact that the last five years look very, very different from the preceding fifty.

Saturday, December 14, 2013

Maybe I was too subtle in that last post...

Bob Murphy commented:

If you are suspicious of Abraham Lincoln, you are going to have a hard time convincing me you care more about liberty than me.

If you are suspicious of the Civil Rights Act and other anti-discrimination, you are going to have a very hard time convincing me you care more about liberty than me.

If you are a pacifist in the face of fascism that threatens the liberty of millions, you are going to have a very hard time convincing me you care more about liberty than me.

And this doesn't even get into the much trickier questions about the tangled net of positive and negative liberty that we're faced with when past inequalities of opportunity generate present inequalities of outcomes. But if you scoff at that as a problem you're going to have a very, very, hard time convincing me you care more about liberty than me.

Which makes me wonder if Bob is in the naïve/ignorant camp more so than I thought. It's one thing to disagree with me. That's allowed. I know he holds a different view and I've always known that and I disagree with him. But he doesn't even seem to be aware of the issue.

"Obviously there are no IUCs possible, but to the extent that we operationalize "who cares more about liberty?" I don't even see how this can be close. I just scrolled through your blog and in the first 3 pages, the only mention I see you making of liberty is to mock/criticize the people who have devoted their lives to defending it. And it's not "Hey guys I strategically disagree with your wonderful aims" but rather "I think these guys are either naive or lying."Here's the thing - I don't (and I think most people don't) look at Bob Murphy, fantastic guy that I think he is, and think "there's a man that's devoted his life to defending liberty". We look at him and think "there's a guy that's devoted his life to fighting the state". And maybe he's OK with that and thinks the two are synonymous, but what he and other libertarians need to recognize is that it's not just that we think the second one (that he devotes himself to fighting the state), but we do not think the first one accurately describes him.

Look, I clearly don't care as much about racial bigotry as people working at the NAACP. That doesn't mean I'm a racist or that I hate black people, it just means it's clearly not as high a priority to me as to them.

By the same token, you clearly care more about economic theory and your kid than liberty. In contrast, I care about liberty, Krugman, and karaoke.

None of this is a judgment, and I'm not saying you're a closet totalitarian, but I can't believe you're acting as if you and your social network care as much about "liberty" as the people I know who do things like move their families to a different state etc. for it."

If you are suspicious of Abraham Lincoln, you are going to have a hard time convincing me you care more about liberty than me.

If you are suspicious of the Civil Rights Act and other anti-discrimination, you are going to have a very hard time convincing me you care more about liberty than me.

If you are a pacifist in the face of fascism that threatens the liberty of millions, you are going to have a very hard time convincing me you care more about liberty than me.

And this doesn't even get into the much trickier questions about the tangled net of positive and negative liberty that we're faced with when past inequalities of opportunity generate present inequalities of outcomes. But if you scoff at that as a problem you're going to have a very, very, hard time convincing me you care more about liberty than me.

Which makes me wonder if Bob is in the naïve/ignorant camp more so than I thought. It's one thing to disagree with me. That's allowed. I know he holds a different view and I've always known that and I disagree with him. But he doesn't even seem to be aware of the issue.

Thursday, December 12, 2013

A question for libertarians

I feel like I've seen the phrase "liberty movement" crop up a lot lately - more than usual. I'm a little puzzled by the uptick, although maybe I'm just imagining it.

In any case, it's certainly not used as often as simply talking about "libertarianism", and I had always assumed the reason it wasn't used as often is because of the way it sounds to me (and by extension, all reasonable people of any political persuasion).

Whenever I hear "liberty movement" used as a synonym for "libertarian" it strikes me as either naïve/ignorant or deliberately distortive and opportunistic.

I always felt like this sense of the phrase was confirmed by the fact that you largely heard it in the context of Libertarian Party political events, Ron Paul stuff, etc.

So my question is - what do libertarians think of the phrase "liberty movement" as a synonym for libertarian? Do you sort of have my impressions (which is what I've always assumed because most of you don't use it all that much), or am I completely off base and you too think this is a good synonym.

I should add this isn't like my concern with the use of the word "classical liberal" to mean "libertarian". Whatever my disagreements with that usage, "classical liberal" is simply terminology and what's at stake to a large extent is dueling claims to a historical and intellectual pedigree. But "liberty movement" isn't just terminology. It's not just a label, in other words - it pretty clearly means "this is the group of people that like liberty" as a way of distinguishing that group from other groups.

In any case, it's certainly not used as often as simply talking about "libertarianism", and I had always assumed the reason it wasn't used as often is because of the way it sounds to me (and by extension, all reasonable people of any political persuasion).

Whenever I hear "liberty movement" used as a synonym for "libertarian" it strikes me as either naïve/ignorant or deliberately distortive and opportunistic.

I always felt like this sense of the phrase was confirmed by the fact that you largely heard it in the context of Libertarian Party political events, Ron Paul stuff, etc.

So my question is - what do libertarians think of the phrase "liberty movement" as a synonym for libertarian? Do you sort of have my impressions (which is what I've always assumed because most of you don't use it all that much), or am I completely off base and you too think this is a good synonym.

I should add this isn't like my concern with the use of the word "classical liberal" to mean "libertarian". Whatever my disagreements with that usage, "classical liberal" is simply terminology and what's at stake to a large extent is dueling claims to a historical and intellectual pedigree. But "liberty movement" isn't just terminology. It's not just a label, in other words - it pretty clearly means "this is the group of people that like liberty" as a way of distinguishing that group from other groups.

Thursday, December 5, 2013

Take a good look backwards as well as forwards in the economics of the minimum wage

Don Boudreaux links to Bryan Caplan, who has an interesting post up pointing out that we need to consider the dynamic response to a minimum wage announcement. I only call it "interesting" because I'm not entirely sure what I think of it yet, but I think it's worth thinking about.

The point is that if a minimum wage hike is passed in advance firms can gradually adjust through reduced hiring and attrition (if indeed that's the direction they would respond - of course if the monopsony model is correct there may be increased hiring gradually). The point is, by the time of the actual discontinuity in the law everything might have happened already.

Maybe.

The trouble I'm having with this is that I'm not sure what would cause the gradual response. If you were making major transitions to capital-intensive production I could see doing that gradually, but presumably that's not what we're talking about in many of these cases (although I suppose that's an empirical question). If you're not doing the same thing, more capital intensively, why not just pay the same amount of people low wages until the minimum wage goes into effect and then pull up stakes? In the high turnover world of fast food franchises (as in, for example, the Card and Krueger study) that seems very reasonable. What glide path are we really thinking of in the Card and Krueger case??

But as I say - it's interesting. I don't quite know the answer.

This reminds me of a post I had a couple weeks back on the minimum wage noting that we have to follow things forward in time before we pass judgment. Why? Because different monopsony models imply different long run effects. If it's a straightforward market power model then the minimum wage (as long as it's modest) should be good in the long and short run. If it's a fixed labor cost version of the monopsony model it will have good short run and bad long run effects. So you need to look a while out to really get a sense of what you're dealing with.

It's an ex-post dynamic response explanation. Here, Bryan and Don are talking about an ex-ante dynamic response. But it's still the same sort of idea.

The point is that if a minimum wage hike is passed in advance firms can gradually adjust through reduced hiring and attrition (if indeed that's the direction they would respond - of course if the monopsony model is correct there may be increased hiring gradually). The point is, by the time of the actual discontinuity in the law everything might have happened already.

Maybe.

The trouble I'm having with this is that I'm not sure what would cause the gradual response. If you were making major transitions to capital-intensive production I could see doing that gradually, but presumably that's not what we're talking about in many of these cases (although I suppose that's an empirical question). If you're not doing the same thing, more capital intensively, why not just pay the same amount of people low wages until the minimum wage goes into effect and then pull up stakes? In the high turnover world of fast food franchises (as in, for example, the Card and Krueger study) that seems very reasonable. What glide path are we really thinking of in the Card and Krueger case??

But as I say - it's interesting. I don't quite know the answer.

This reminds me of a post I had a couple weeks back on the minimum wage noting that we have to follow things forward in time before we pass judgment. Why? Because different monopsony models imply different long run effects. If it's a straightforward market power model then the minimum wage (as long as it's modest) should be good in the long and short run. If it's a fixed labor cost version of the monopsony model it will have good short run and bad long run effects. So you need to look a while out to really get a sense of what you're dealing with.

It's an ex-post dynamic response explanation. Here, Bryan and Don are talking about an ex-ante dynamic response. But it's still the same sort of idea.

Tuesday, December 3, 2013

My new Critical Review article is out

Share far and wide.

Many readers of this blog gave me reactions to this, and for that I am very grateful.

I hope people will be interested in it. I like to think of it as a thoughtful analysis of Hayek's business cycle theory. I come out liking his capital theory for both theoretical and empirical reasons, and not liking the business cycle theory for both theoretical and empirical reasons.

I offer what I think is a new way of putting what I think is wrong with his business cycle theory that I think is right with Keynes, and it connects both of them back to their Wicksellian roots. I don't mention Wicksell specifically so as not to overcomplicate the argument. I had been planning on including it, and it was certainly in the back of my head when I was writing it.

I also think it's a nice paper in that it collects and reviews the scope of the empirical literature. I don't do that in grueling detail (it's really not the venue for that), but I think that my separation of the studies into what can be thought of as reduced form and structural analyses helps a lot to clarify what we do and don't know.

And if nothing else I provide what I think is the most or at least one of the most comprehensive empirical lit reviews.

Many readers of this blog gave me reactions to this, and for that I am very grateful.

I hope people will be interested in it. I like to think of it as a thoughtful analysis of Hayek's business cycle theory. I come out liking his capital theory for both theoretical and empirical reasons, and not liking the business cycle theory for both theoretical and empirical reasons.

I offer what I think is a new way of putting what I think is wrong with his business cycle theory that I think is right with Keynes, and it connects both of them back to their Wicksellian roots. I don't mention Wicksell specifically so as not to overcomplicate the argument. I had been planning on including it, and it was certainly in the back of my head when I was writing it.

I also think it's a nice paper in that it collects and reviews the scope of the empirical literature. I don't do that in grueling detail (it's really not the venue for that), but I think that my separation of the studies into what can be thought of as reduced form and structural analyses helps a lot to clarify what we do and don't know.

And if nothing else I provide what I think is the most or at least one of the most comprehensive empirical lit reviews.

Cranky about Franky

This has been a cranky week for libertarians, between people suggesting that maybe it would be nice if workers could be in a position to stay with their families on holidays, maybe we shouldn't be so consumption focused over the holidays, and maybe exclusion of the poor is a problem in market economies.

It is the last point that I want to talk about a little and provide a quick quote I like.

Pope Francis's recent pronouncement was admittedly overwrought (like Greg Mankiw, I thought the discussion of "trickle down" in a Vatican document looked ridiculous. But I don't get the uproar over the broader point.

People act like the pope was denying that markets raise people out of poverty. It seems to me he wasn't denying that at all. I can't even imagine what would get people to think he was saying that except they're on a hair-trigger and jump at anyone questioning a libertarianish party line as being entirely anti-market.

It seemed to me all the pope said was that market economies will produce winners and losers, and that a group of people - by circumstances of birth and disadvantage relative to the wealthy - can be left out of a lot of the gains of the market economy.

This seems to me to be obviously true.

It's not a statement that markets fail to reduce poverty. I obviously thinkl markets do reduce poverty, but I also think they exclude people. The two are not contradictory. I highly doubt Pope Francis misses this point. When markets were under threat, the papacy did not have any trouble standing against socialism. I doubt there's a major about face now and there was certainly no indication of that in what I read.

I promised a quote. I particularly liked this one:

"Just as the commandment “Thou shalt not kill” sets a clear limit in order to safeguard the value of human life, today we also have to say “thou shalt not” to an economy of exclusion and inequality."

It is the last point that I want to talk about a little and provide a quick quote I like.

Pope Francis's recent pronouncement was admittedly overwrought (like Greg Mankiw, I thought the discussion of "trickle down" in a Vatican document looked ridiculous. But I don't get the uproar over the broader point.

People act like the pope was denying that markets raise people out of poverty. It seems to me he wasn't denying that at all. I can't even imagine what would get people to think he was saying that except they're on a hair-trigger and jump at anyone questioning a libertarianish party line as being entirely anti-market.

It seemed to me all the pope said was that market economies will produce winners and losers, and that a group of people - by circumstances of birth and disadvantage relative to the wealthy - can be left out of a lot of the gains of the market economy.

This seems to me to be obviously true.

It's not a statement that markets fail to reduce poverty. I obviously thinkl markets do reduce poverty, but I also think they exclude people. The two are not contradictory. I highly doubt Pope Francis misses this point. When markets were under threat, the papacy did not have any trouble standing against socialism. I doubt there's a major about face now and there was certainly no indication of that in what I read.

I promised a quote. I particularly liked this one:

"Just as the commandment “Thou shalt not kill” sets a clear limit in order to safeguard the value of human life, today we also have to say “thou shalt not” to an economy of exclusion and inequality."

Some links

1. C-SPAN aired an excellent hearing today on abuses of presidential power specifically in the area of encroachments on legislative power.

2. Ben Harris (Urban Institute/Brookings Tax Policy Center) explains why the next debt ceiling fight is likely to be worse than the latest one.

3. A summary of a recent discussion by Mike Rowe on elitism in employment and education, and what you could call non-academic skilled work. Richard Vedder is on Rowe's side, which was nice to see - I usually don't find a lot to agree with from Vedder.

4. The New York Times on apprenticeship. Great article. It quotes the chair of my dissertation committee on the first page.

5. Speaking of my chair, vote for his daughter's group - Maya and the Ruins - at Folk Alley's 2013 listener poll. It's a few steps... you've got to register, confirm an email they send, and then click on it again to vote. But I know 90% of my readers are not doing anything particularly productive with their time. Willie Nelson is also on the list, which gave me pause, but I felt OK voting for Maya and the Ruins cause I don't think it'll put much of a dent in Willie's career.

2. Ben Harris (Urban Institute/Brookings Tax Policy Center) explains why the next debt ceiling fight is likely to be worse than the latest one.

3. A summary of a recent discussion by Mike Rowe on elitism in employment and education, and what you could call non-academic skilled work. Richard Vedder is on Rowe's side, which was nice to see - I usually don't find a lot to agree with from Vedder.

4. The New York Times on apprenticeship. Great article. It quotes the chair of my dissertation committee on the first page.

5. Speaking of my chair, vote for his daughter's group - Maya and the Ruins - at Folk Alley's 2013 listener poll. It's a few steps... you've got to register, confirm an email they send, and then click on it again to vote. But I know 90% of my readers are not doing anything particularly productive with their time. Willie Nelson is also on the list, which gave me pause, but I felt OK voting for Maya and the Ruins cause I don't think it'll put much of a dent in Willie's career.

Monday, December 2, 2013

Another interesting glimpse into how well Bryan Caplan would do on a Turing test

The question he asks is what evil in plain sight today will be abhorred by our descendants. Interestingly, he frames this in terms of political ideologies - liberalism, conservatism, and libertarianism. He claims that liberalism offers us the problem of cruelty to animals, conservatism offers us the problem of abortion, and libertarianism offers us the problem of our treatment of foreigners.

The really odd pair are the liberal/libertarian options. Before getting to that I want to say that he makes a good point on abortion. I'm pro-choice, but I've come around to the view that pro-lifers (I used to be one of them too!) have a potentially legitimate case. Of course it all depends on personhood which is not an easy thing to know what to think of. Having been through a pregnancy and having a child now I still don't know what to think of the question of personhood. Indeed that's a big part of why I'm pro-choice. In the face of such a contested question I find it hard to tell everyone to follow one viewpoint. But if the conservative view is correct this is a monstrosity.

OK, back to liberalism and libertarianism.

The liberalism one was weak and the libertarian one was confusing.

We're animals, and animals eat other animals. Most liberals are happy to eat other animals for exactly this reason. Tough luck - you're below us on the food chain. Of course outright cruelty to animals isn't a good thing, but that's not what Bryan is talking about and do you really have to be a liberal to think that cruelty to animals is bad? I hope not. Bryan takes some unusual life-style choices that are plausibly more common among liberals and invents a moral problem where there really isn't one.

The libertarian case - our treatment of foreigners - is confusing because I think of this as being a liberal thing as much as a libertarian thing. And indiscriminate pacifism on the part of some libertarians (and liberals) is not better treatment of foreigners, it's worse treatment. It's not that this isn't characteristic of a lot of libertarians (although many are anti-immigration), but it just doesn't seem as distinctive as Bryan would like it to be.

There is a very obvious liberal option that is different from conservatism or libertarianism: concern for individuals who happen to be disadvantaged due to the circumstances of their birth. I'm not just talking about feeling bad for the disadvantaged any more than Bryan is talking about just feeling bad for slaves. Everyone feels bad for the disadvantaged. I'm talking about using the coercive power of government to put a stop to a barbarity. Presumably Bryan is supportive of legally barring the ownership of other human beings. He is contemplating legally barring abortion.

The willingness to use the power of the state to help those who are disadvantaged by chance is something that I think our descendants are going to look back on and be shocked that we didn't do more to address.

The really odd pair are the liberal/libertarian options. Before getting to that I want to say that he makes a good point on abortion. I'm pro-choice, but I've come around to the view that pro-lifers (I used to be one of them too!) have a potentially legitimate case. Of course it all depends on personhood which is not an easy thing to know what to think of. Having been through a pregnancy and having a child now I still don't know what to think of the question of personhood. Indeed that's a big part of why I'm pro-choice. In the face of such a contested question I find it hard to tell everyone to follow one viewpoint. But if the conservative view is correct this is a monstrosity.

OK, back to liberalism and libertarianism.

The liberalism one was weak and the libertarian one was confusing.

We're animals, and animals eat other animals. Most liberals are happy to eat other animals for exactly this reason. Tough luck - you're below us on the food chain. Of course outright cruelty to animals isn't a good thing, but that's not what Bryan is talking about and do you really have to be a liberal to think that cruelty to animals is bad? I hope not. Bryan takes some unusual life-style choices that are plausibly more common among liberals and invents a moral problem where there really isn't one.

The libertarian case - our treatment of foreigners - is confusing because I think of this as being a liberal thing as much as a libertarian thing. And indiscriminate pacifism on the part of some libertarians (and liberals) is not better treatment of foreigners, it's worse treatment. It's not that this isn't characteristic of a lot of libertarians (although many are anti-immigration), but it just doesn't seem as distinctive as Bryan would like it to be.

There is a very obvious liberal option that is different from conservatism or libertarianism: concern for individuals who happen to be disadvantaged due to the circumstances of their birth. I'm not just talking about feeling bad for the disadvantaged any more than Bryan is talking about just feeling bad for slaves. Everyone feels bad for the disadvantaged. I'm talking about using the coercive power of government to put a stop to a barbarity. Presumably Bryan is supportive of legally barring the ownership of other human beings. He is contemplating legally barring abortion.

The willingness to use the power of the state to help those who are disadvantaged by chance is something that I think our descendants are going to look back on and be shocked that we didn't do more to address.

Friday, November 22, 2013

My last slide on Hayek today

The Hayek lecture today is going to start with a brief run through of the Austrian school from Menger to the present (we've already covered Menger and Bohm-Bawerk), followed by a brief bibliography of Hayek, one student talking briefly about his long essay on the socialist calculation debate, and then the bulk of the lecture will be on ABCT.

Then I have a slide at the end to motivate discussion until the end of class. I thought you all might be interested in it. We talked about Vernon Smith when we discussed "modern Smithians" in the Adam Smith lectures, so they are familiar with constructivist vs. ecological rationality.

The important things for me are for them to understand Hayek is making more than just a libertarian claim - he's making a claim about spontaneous order and planning. Second, I want them to just think through all the things economists have said that we've discussed and how it applies to the Fatal Conceit quote, and third I want to challenge them to not take Hayek at face value.

Exactly why isn't a radical change to the evolved social order like libertarianism in flat contradiction of the point Hayek is trying to communicate here?!?!

Most of the lecture is straight up ABCT, but I think this will be a discussion they will be more interested in ending with.

Then I have a slide at the end to motivate discussion until the end of class. I thought you all might be interested in it. We talked about Vernon Smith when we discussed "modern Smithians" in the Adam Smith lectures, so they are familiar with constructivist vs. ecological rationality.

The important things for me are for them to understand Hayek is making more than just a libertarian claim - he's making a claim about spontaneous order and planning. Second, I want them to just think through all the things economists have said that we've discussed and how it applies to the Fatal Conceit quote, and third I want to challenge them to not take Hayek at face value.

Exactly why isn't a radical change to the evolved social order like libertarianism in flat contradiction of the point Hayek is trying to communicate here?!?!

Most of the lecture is straight up ABCT, but I think this will be a discussion they will be more interested in ending with.

Wednesday, November 20, 2013

The only thing sadder than me doing my first post in over a week griping about a Wikipedia entry...

...is Bob Murphy doing a post griping about me griping about a Wikipedia entry.

(784% longer than my original post, too!)

(784% longer than my original post, too!)

Tuesday, November 19, 2013

Wikipedia fail

15% of the Wikipedia article on liquidity preference is about Rothbard.

Internet Austrians are completely delusional about the extent to which what they think matters.

Internet Austrians are completely delusional about the extent to which what they think matters.

Sunday, November 10, 2013

A question for readers who know what's going on internationally better than I do

Do you know of a good resource for information on sub-national labor market policies - especially employment protection policies or anything impacting turnover rates - in:

1. Germany

2. Switzerland

3. Austria

4. Canada

5. Austrailia

Also do you know of excellent up to date books on labor markets and labor market policies in the first three?

My third essay, I think, is going to have a strong comparative component to it and I need to bone up on some other labor markets

1. Germany

2. Switzerland

3. Austria

4. Canada

5. Austrailia

Also do you know of excellent up to date books on labor markets and labor market policies in the first three?

My third essay, I think, is going to have a strong comparative component to it and I need to bone up on some other labor markets

Saturday, November 9, 2013

How economists think about market imperfections: an anecdote

You'll often hear from libertarians that "mainstream" economists are preoccupied with market imperfections because it's an excuse to push policy, criticize the market, or both. A good example was Don Boudreaux the other day thinking that Alan Manning was criticizing markets in general just because he has issues with models of perfect competition. Of course just about any non-libertarian is more willing to muse on certain types of policy options than libertarians, but generally speaking I think that understanding of mainstream economics of imperfect competition is silly.

I've got a good anecdote from yesterday's labor class where we were talking about asymmetric information and statistical discrimination. It was a great discussion, but we didn't say a single word about policy or government. We never mentioned it once. The more active parts of the discussion revolved around:

1. Making sense of some of the odd diagramming approaches in Cahuc and Zylberberg.

2. Me bitching (believe it or not, I do that in class too) about some assumptions in the textbook treatment that higher productivity workers would have higher reservation wages. I think outside options are much more sensible way of motivating how asymmetric information leads to adverse selection. It's a little different from the lemons model in that sense.

3. Real world examples.

We also got off topic (we do that) and talked about the IZA labor conference on Monday, our papers, classes next semester, and of course Caroline.

We didn't talk about public policies to address imperfections in the entire two and a half hour class.

I do not think this is unusual.

We deal with these models because they are good at explaining the way the world works, period. To the extent that we care about policy of course models that explain how the world works are the ones you should use to inform policy.

I've got a good anecdote from yesterday's labor class where we were talking about asymmetric information and statistical discrimination. It was a great discussion, but we didn't say a single word about policy or government. We never mentioned it once. The more active parts of the discussion revolved around:

1. Making sense of some of the odd diagramming approaches in Cahuc and Zylberberg.

2. Me bitching (believe it or not, I do that in class too) about some assumptions in the textbook treatment that higher productivity workers would have higher reservation wages. I think outside options are much more sensible way of motivating how asymmetric information leads to adverse selection. It's a little different from the lemons model in that sense.

3. Real world examples.

We also got off topic (we do that) and talked about the IZA labor conference on Monday, our papers, classes next semester, and of course Caroline.

We didn't talk about public policies to address imperfections in the entire two and a half hour class.

I do not think this is unusual.

We deal with these models because they are good at explaining the way the world works, period. To the extent that we care about policy of course models that explain how the world works are the ones you should use to inform policy.

Four thoughts on Cochrane on New and Old Keynesianism

It's an interesting post but I disagree with him on (at least) four counts:

(1.) Nobody really thinks (well, maybe Cochrane does) that the NK consumption function is exactly right. We bring in intertemporal optimization because people do plan for the future, but people still think that current or at least near/medium term income matters for psychological/behavioral reasons if nothing else,

(2.) so with MPC = 0 if government spending doesn't crowd out you've still got a case for government spending. The problems only come in if government crowds out. Insofar as government commits to major investment programs, and insofar as we think investment is governed by expectations of future demand, you get positive multipliers again (of course, by a different mechanism than the Old Keynesian multipliers).

(3.) The whole MPC/income thing goes out the window when we consider credit constrained, paycheck-to-paycheck people, which leads me to

(4.) It's true politicians talk like Old Keynesians. I think economists do this less - they focus on my (2.). When we do talk about MPC it's almost always with reference to something like (3.).

So it's a good post laying out the issues, although I don't buy all the "you silly Old Keynesian" implications. I agree with Krugman that the Old Keynesian intuitions hold up surprisingly well, even if the mechanisms do change.

(1.) Nobody really thinks (well, maybe Cochrane does) that the NK consumption function is exactly right. We bring in intertemporal optimization because people do plan for the future, but people still think that current or at least near/medium term income matters for psychological/behavioral reasons if nothing else,

(2.) so with MPC = 0 if government spending doesn't crowd out you've still got a case for government spending. The problems only come in if government crowds out. Insofar as government commits to major investment programs, and insofar as we think investment is governed by expectations of future demand, you get positive multipliers again (of course, by a different mechanism than the Old Keynesian multipliers).

(3.) The whole MPC/income thing goes out the window when we consider credit constrained, paycheck-to-paycheck people, which leads me to

(4.) It's true politicians talk like Old Keynesians. I think economists do this less - they focus on my (2.). When we do talk about MPC it's almost always with reference to something like (3.).

So it's a good post laying out the issues, although I don't buy all the "you silly Old Keynesian" implications. I agree with Krugman that the Old Keynesian intuitions hold up surprisingly well, even if the mechanisms do change.

Thursday, November 7, 2013

Great post from Don Boudreaux on Ken Arrow and the Virginia election

Here.

I kind of take this point like I take Sraffa's critique of Hayek or certain criticisms of marginalism: it's a good reminder to avoid sloppy talk.

I think we can make statements about the public good, we just have to recognize two things:

1. There is no actual actor that is the collective, and

2. What we identify as the public good is of necessity normative even if it is informed by everyone else's utility function.

So I would feel perfectly comfortable talking about the need for an egalitarian society and potentially legislation to achieve that as being in the public good or even an American ideal. I might use language Don would consider collectivist.

I can make the claim quite legitimately that I come to this conclusion based on some sort of aggregation of what other Americans think. It's a rough, back of the envelope aggregation on my part, but it's legitimately an aggregation of individual preferences.

But it's not some sort of objective, uncontestable aggregation of those preferences. Instead it's an aggregation based on my some of my own values as well (which, in fair divinations of the public spirit, is itself derived from public values and virtues). This isn't a useless way of talking about the public good, but it isn't objective either - not in the same way that my preferences are (they are subjective of course, but I can objectively say "Daniel prefers X").

Similarly when we get an election result it's tough to say that it is the public's will. What we have to recognize is that it is one aggregation of individual preferences, and the aggregation is done according to the dictates of a certain set of democratic institutions.

THAT is a fair, objective claim about what this "public will" is.

As Ken Arrow and Don Boudreaux discuss, it's not legitimate to talk about this as an actual sensible preference set on its own. It isn't.

As individuals and as citizens, what we have to decide is whether those mediating democratic institutions aggregate preferences in a way that we like or not.

I kind of take this point like I take Sraffa's critique of Hayek or certain criticisms of marginalism: it's a good reminder to avoid sloppy talk.

I think we can make statements about the public good, we just have to recognize two things:

1. There is no actual actor that is the collective, and

2. What we identify as the public good is of necessity normative even if it is informed by everyone else's utility function.

So I would feel perfectly comfortable talking about the need for an egalitarian society and potentially legislation to achieve that as being in the public good or even an American ideal. I might use language Don would consider collectivist.

I can make the claim quite legitimately that I come to this conclusion based on some sort of aggregation of what other Americans think. It's a rough, back of the envelope aggregation on my part, but it's legitimately an aggregation of individual preferences.

But it's not some sort of objective, uncontestable aggregation of those preferences. Instead it's an aggregation based on my some of my own values as well (which, in fair divinations of the public spirit, is itself derived from public values and virtues). This isn't a useless way of talking about the public good, but it isn't objective either - not in the same way that my preferences are (they are subjective of course, but I can objectively say "Daniel prefers X").

Similarly when we get an election result it's tough to say that it is the public's will. What we have to recognize is that it is one aggregation of individual preferences, and the aggregation is done according to the dictates of a certain set of democratic institutions.

THAT is a fair, objective claim about what this "public will" is.

As Ken Arrow and Don Boudreaux discuss, it's not legitimate to talk about this as an actual sensible preference set on its own. It isn't.

As individuals and as citizens, what we have to decide is whether those mediating democratic institutions aggregate preferences in a way that we like or not.

Sunday, November 3, 2013

Field Turing Tests

So you've all heard of Turing tests, but what's probably more important is Field Turing Tests - similar to the distinction between experimental and field tests elsewhere.

A Turing test is useful because it gives you a sense of whether the other person really comprehends what they're arguing with. That's helpful in assessing the quality of the process by which they form arguments, etc.

But it doesn't necessarily mean that they're good interacting with people in the marketplace of ideas. For that, you need a field Turing test. Out in the wild, do people present the ideas they disagree with in a way that would convince someone from the other side.

This just comes to mind as a result of (what I hope is the end of) a long set of diffuse interactions with Don Boudreaux over monopsony. My concluding thought has been "my God I hope nobody just reads Café Hayek and doesn't read this blog to understand what I think about this issue". There's been some really awful misrepresentation from Don.

I've had similar fears in the last few months about my immigration work - I hope people don't just read stuff at Brookings, ITIF, or from Vivek Wadhwa on our immigration work. If they do they're going to completely miss the point.

The way around that is to be well engaged and a self-promoter of course. I've been in dialogue with people at Brookings and ITIF (Vivek infuriates me too much to talk with, although ITIF has been almost as bad - perhaps that's wrong of me). I've published at EPI, EconLib, and Cato on the issue which I think is very helpful.

But then there are good actors too - people you never have to worry about. David Henderson and Bryan Caplan always represent the other side pretty accurately. Any quibbles with their accounts would be idiosyncratic - not systematic. Bob Murphy is usually great, although I find some of his Krugman posts not just cases I disagree with, but very odd in their reading of Krugman (but we can bracket those off for the sake of this argument). Ryan Murphy and Jonathan Catalan are always great at this among us junior bloggers.

Those are the obvious ones on the libertarian side of things. Cochrane and Williamson are usually quite good on this count too. Horwitz can be OK on more analytical pieces but pretty bad on polemical pieces. This is a huge weak point for Boettke who I think is best read for his brilliant expositions and deep knowledge of his own side. Russ is in the same boat as Don.

Who do you think is especially good at this or especially bad at this on either side?

I think I'm pretty good. I provide accounts of the other side that I know they don't like (for example, the whole point about libertarianism vs. propertarianism and the idea that "liberty movement" is pure euphemism), but I hope I'm clear that this is my take on their position and not the position they are under the impression that they hold. Perhaps making that distinction clear is all that a successful performance in a field Turing test requires.

A Turing test is useful because it gives you a sense of whether the other person really comprehends what they're arguing with. That's helpful in assessing the quality of the process by which they form arguments, etc.

But it doesn't necessarily mean that they're good interacting with people in the marketplace of ideas. For that, you need a field Turing test. Out in the wild, do people present the ideas they disagree with in a way that would convince someone from the other side.

This just comes to mind as a result of (what I hope is the end of) a long set of diffuse interactions with Don Boudreaux over monopsony. My concluding thought has been "my God I hope nobody just reads Café Hayek and doesn't read this blog to understand what I think about this issue". There's been some really awful misrepresentation from Don.

I've had similar fears in the last few months about my immigration work - I hope people don't just read stuff at Brookings, ITIF, or from Vivek Wadhwa on our immigration work. If they do they're going to completely miss the point.

The way around that is to be well engaged and a self-promoter of course. I've been in dialogue with people at Brookings and ITIF (Vivek infuriates me too much to talk with, although ITIF has been almost as bad - perhaps that's wrong of me). I've published at EPI, EconLib, and Cato on the issue which I think is very helpful.

But then there are good actors too - people you never have to worry about. David Henderson and Bryan Caplan always represent the other side pretty accurately. Any quibbles with their accounts would be idiosyncratic - not systematic. Bob Murphy is usually great, although I find some of his Krugman posts not just cases I disagree with, but very odd in their reading of Krugman (but we can bracket those off for the sake of this argument). Ryan Murphy and Jonathan Catalan are always great at this among us junior bloggers.

Those are the obvious ones on the libertarian side of things. Cochrane and Williamson are usually quite good on this count too. Horwitz can be OK on more analytical pieces but pretty bad on polemical pieces. This is a huge weak point for Boettke who I think is best read for his brilliant expositions and deep knowledge of his own side. Russ is in the same boat as Don.

Who do you think is especially good at this or especially bad at this on either side?

I think I'm pretty good. I provide accounts of the other side that I know they don't like (for example, the whole point about libertarianism vs. propertarianism and the idea that "liberty movement" is pure euphemism), but I hope I'm clear that this is my take on their position and not the position they are under the impression that they hold. Perhaps making that distinction clear is all that a successful performance in a field Turing test requires.

Instrumental variables get a pass on rigor because economists essentially use them for personal entertainment...

That last line isn't entirely fair. There are some good IV studies out there, but IMO they are the ones that use a bazillion different robustness checks to assure you they're not full of shit.

So take that as poetic license and shift attention to the first part of the title.

I'm doing some work right now for a class paper (and hopefully a publication some time in the future) on within-study tests of propensity score matching. Similar papers are out there for other methods but I'm working with PSM. As anyone that's worked with the method before knows, it's decent enough but very dicey. You have to really know what kinds of selection mechanisms are in play to make it useful because it's simply not a solution to the problem we worry about most: selection on unobservables. It ONLY works for selection on observables that we're not good at modeling. In a panel framework you can make the case that selection on unobservables is accounted for by using past data (i.e. - I don't see my unobservables but I match on wages at t-1 and since I'm interested in wages at t+1, all the unobservables I think affect wages at t+1 are also affecting wages at t-1 in the same way, so by matching on t-1 I'm OK).

We've learned much of this about PSM from random assignment studies that use PSM to test a result with real world data (lots of this can be shown with simulation, but simulation isn't necessarily relevant to outcomes in the real world).

This is true of most quasi-experimental methods. There's usually a literature on within-study tests of the method comparing to random assignment. This is a great way to learn about the limits of our quasi-experimental options, and that's always good to know especially when we only have quasi-experimental options).

As far as I know, though, there's no such within-study test of IV estimators. There's lots of within-study comparisons to OLS but that's a different exercise entirely. If they're both biased then who cares if it's close to OLS or not?

I'm not entirely sure why this is, except that IVs aren't generally used for evaluations where you might have random assignment. Instead they're used for more fundamental scientific questions. But at least in the returns to education literature you'd think this could be possible.

One more reason to have a healthy skepticism of IVs.

So take that as poetic license and shift attention to the first part of the title.

I'm doing some work right now for a class paper (and hopefully a publication some time in the future) on within-study tests of propensity score matching. Similar papers are out there for other methods but I'm working with PSM. As anyone that's worked with the method before knows, it's decent enough but very dicey. You have to really know what kinds of selection mechanisms are in play to make it useful because it's simply not a solution to the problem we worry about most: selection on unobservables. It ONLY works for selection on observables that we're not good at modeling. In a panel framework you can make the case that selection on unobservables is accounted for by using past data (i.e. - I don't see my unobservables but I match on wages at t-1 and since I'm interested in wages at t+1, all the unobservables I think affect wages at t+1 are also affecting wages at t-1 in the same way, so by matching on t-1 I'm OK).

We've learned much of this about PSM from random assignment studies that use PSM to test a result with real world data (lots of this can be shown with simulation, but simulation isn't necessarily relevant to outcomes in the real world).

This is true of most quasi-experimental methods. There's usually a literature on within-study tests of the method comparing to random assignment. This is a great way to learn about the limits of our quasi-experimental options, and that's always good to know especially when we only have quasi-experimental options).

As far as I know, though, there's no such within-study test of IV estimators. There's lots of within-study comparisons to OLS but that's a different exercise entirely. If they're both biased then who cares if it's close to OLS or not?

I'm not entirely sure why this is, except that IVs aren't generally used for evaluations where you might have random assignment. Instead they're used for more fundamental scientific questions. But at least in the returns to education literature you'd think this could be possible.

One more reason to have a healthy skepticism of IVs.

Quick note on Mario Rizzo and food stamps

Mario Rizzo argues here that foodstamps are becoming a new entitlement, highlighting the fact that their use has not declined with unemployment, suggesting that they are not offering a counter-cyclical stabilizer the way Keynesians suggest.

This is a perfect example of where it's important to use employment to population ratios rather than unemployment rates. If you use the latter you probably think we've been going through a slow but steady recovery. If you use the former you think we've been virtually at a standstill for the last couple years.

And note that's the behavior of food stamp participation - it's growing, but the growth has leveled off as declines in employment have leveled off. Think about what you're measuring. The unemployment rate is an important indicator but if you're concerned with economic hardship more generally - or with the volume of employment (the Keynesian concern) there are probably better statistics particularly in a recovery like this one.

As Rizzo notes, there are changes associated with benefit take-up. That might imply a leveling up of food stamps (and if we like the eligibility rules now and after this recession is over, what's the real problem with robust take-up?). But as far as the counter-cyclical question he raises, I don't see any reason to believe it's not just as counter-cyclical as ever. That's because he and I seem to have different perspectives on where in the cycle we are exactly.

I find his discussion at the end about the self-generating recovery nature of Keynesian policies very odd. But then again, he thinks we've had a lot of stimulus and I don't see much evidence for that after 2009/early 2010. That's on top of the fact that liquidity traps and financial crises are going to be especially hard to climb out of even in the best policy environments.

This is a perfect example of where it's important to use employment to population ratios rather than unemployment rates. If you use the latter you probably think we've been going through a slow but steady recovery. If you use the former you think we've been virtually at a standstill for the last couple years.

And note that's the behavior of food stamp participation - it's growing, but the growth has leveled off as declines in employment have leveled off. Think about what you're measuring. The unemployment rate is an important indicator but if you're concerned with economic hardship more generally - or with the volume of employment (the Keynesian concern) there are probably better statistics particularly in a recovery like this one.

As Rizzo notes, there are changes associated with benefit take-up. That might imply a leveling up of food stamps (and if we like the eligibility rules now and after this recession is over, what's the real problem with robust take-up?). But as far as the counter-cyclical question he raises, I don't see any reason to believe it's not just as counter-cyclical as ever. That's because he and I seem to have different perspectives on where in the cycle we are exactly.

I find his discussion at the end about the self-generating recovery nature of Keynesian policies very odd. But then again, he thinks we've had a lot of stimulus and I don't see much evidence for that after 2009/early 2010. That's on top of the fact that liquidity traps and financial crises are going to be especially hard to climb out of even in the best policy environments.

HET class blog post of interest

We talked about the early monetarists on Friday and I posted this question. It's pretty straightforward for most readers of this blog, but perhaps some will get something out of it. Still always good to remember:

Accounting identities/Tautologies vs. Behavioral laws

Posted by Daniel Kuehn at Sunday, November 3, 2013 4:59:15 AM EST

In class we went briefly over how the quantity theory of money is just an accounting identity, and how Wicksell, Fisher, and Keynes pointed out that it's dangerous to draw conclusions from accounting identities without having specific economic theories about the behavior of the variables in the identity.

Another identity you're all familiar with (that we'll work with in studying Keynes in the next couple weeks) is the national income equation:

Y = C + I + G + NX

If I were to present as my argument "The national income equation shows us that if you increase G, government spending, you will increase Y, national income, so policymakers should increase spending in a recession", is this a good or a bad argument for fiscal policy? More importantly (because obviously I wouldn't be asking the question if it was a good argument!): why is or isn't it a good argument, and if it isn't a good argument what would a good argument look like?

Accounting identities/Tautologies vs. Behavioral laws

Posted by Daniel Kuehn at Sunday, November 3, 2013 4:59:15 AM EST

In class we went briefly over how the quantity theory of money is just an accounting identity, and how Wicksell, Fisher, and Keynes pointed out that it's dangerous to draw conclusions from accounting identities without having specific economic theories about the behavior of the variables in the identity.

Another identity you're all familiar with (that we'll work with in studying Keynes in the next couple weeks) is the national income equation:

Y = C + I + G + NX

If I were to present as my argument "The national income equation shows us that if you increase G, government spending, you will increase Y, national income, so policymakers should increase spending in a recession", is this a good or a bad argument for fiscal policy? More importantly (because obviously I wouldn't be asking the question if it was a good argument!): why is or isn't it a good argument, and if it isn't a good argument what would a good argument look like?

One more point on perfect competition (and why I think Don Boudreaux has been so confusing)

Textbook perfect competition really boils down to two things: (1.) nobody has market power, and (2.) nobody can earn an economic profit.

If you are criticizing someone who is simply saying that most people have market power and lots of people can earn an economic profit, then don't be surprised when people think you are presenting a naïve perfect competition view in contrast to the way competition works in the real world.

If you are criticizing someone who is simply saying that most people have market power and lots of people can earn an economic profit, then don't be surprised when people think you are presenting a naïve perfect competition view in contrast to the way competition works in the real world.

Against "perfect competition"

On the comment thread of a post by David Henderson, Don Boudreaux shares a great blurb for Alan Manning's book "Monopsony in Motion" that drives home an important point:

The conversation with Don has been confusing to say the least. On David's thread he was reading this as Manning criticizing markets. At the time that struck me as Don confusing blackboard perfect competition with markets, and I told him as much. Now he's got a post on his own blog saying precisely the opposite - contrasting perfect competition with market competition in the real world.

So now he seems on board with Manning and me, but he still seems to think he's not on board.

So I'm hopelessly confused by Don now, but the fact remains that it's critical to draw this distinction between perfect competition like you learn in Econ 101 and market competition, which is full of frictions and irregularities and which unfolds over time as a part of a process of social interaction. In the market you are always dealing with a lot of market power - monopolistic and monopsonistic. Entrepreneurs (among employers and employees, I should emphasize) spend their time doing two things - (1.) figuring out how to compete away the market power of others, and (2.) figuring out how to gin up some market power for themselves. Any time you do something to make yourself indispensable you're generating market power for yourself. You have monopoly rents over what you have to offer, to say nothing of the power over the information about yourself in your brain. And we use that power all the time in the real world.

So the real world is very much Alan Manning's world. Markets are a process where people figure things out and develop new advantages for themselves. It's not textbook perfect competition.

The best that can be said for perfect competition is that it can offer a useful simplification in a bigger model in some cases. Old Keynesian theory worked that way. It used perfect competition assumptions because it was easy, others were assuming it, and the focus was elsewhere. Both Post Keynesian and New Keynesian analysis has dropped those assumptions because we can do better. But the assumptions served their purpose for a time (and they're still useful when you're introducing people to Keynesian ideas). There are presumably other examples like this.

But never mistake the occasional pedagogical value of perfect competition for a picture of the real world.

"What happens if an employer cuts wages by one cent? Much of labor economics is built on the assumption that all the workers will quit immediately. Here, Alan Manning mounts a systematic challenge to the standard model of perfect competition. Monopsony in Motion stands apart by analyzing labor markets from the real-world perspective that employers have significant market (or monopsony) power over their workers. Arguing that this power derives from frictions in the labor market that make it time-consuming and costly for workers to change jobs, Manning re-examines much of labor economics based on this alternative and equally plausible assumption."If you've read the book, you know that Manning hits this idea of perfect competition hard in the first chapter, pointing out how broad the use of it is in textbook economics and how little time is spent with monopsony cases (of course, quite a bit more time is spent with monopoly - he's thinking in terms of labor texts).

The conversation with Don has been confusing to say the least. On David's thread he was reading this as Manning criticizing markets. At the time that struck me as Don confusing blackboard perfect competition with markets, and I told him as much. Now he's got a post on his own blog saying precisely the opposite - contrasting perfect competition with market competition in the real world.

So now he seems on board with Manning and me, but he still seems to think he's not on board.

So I'm hopelessly confused by Don now, but the fact remains that it's critical to draw this distinction between perfect competition like you learn in Econ 101 and market competition, which is full of frictions and irregularities and which unfolds over time as a part of a process of social interaction. In the market you are always dealing with a lot of market power - monopolistic and monopsonistic. Entrepreneurs (among employers and employees, I should emphasize) spend their time doing two things - (1.) figuring out how to compete away the market power of others, and (2.) figuring out how to gin up some market power for themselves. Any time you do something to make yourself indispensable you're generating market power for yourself. You have monopoly rents over what you have to offer, to say nothing of the power over the information about yourself in your brain. And we use that power all the time in the real world.

So the real world is very much Alan Manning's world. Markets are a process where people figure things out and develop new advantages for themselves. It's not textbook perfect competition.

The best that can be said for perfect competition is that it can offer a useful simplification in a bigger model in some cases. Old Keynesian theory worked that way. It used perfect competition assumptions because it was easy, others were assuming it, and the focus was elsewhere. Both Post Keynesian and New Keynesian analysis has dropped those assumptions because we can do better. But the assumptions served their purpose for a time (and they're still useful when you're introducing people to Keynesian ideas). There are presumably other examples like this.

But never mistake the occasional pedagogical value of perfect competition for a picture of the real world.

Saturday, November 2, 2013

Some links

- David Henderson makes much the same point I did earlier about Don Boudreaux's weak case against monopsony in minimum wage labor markets.

- Jared Bernstein on the problem of the coincidence of market failure and government failure. Surprisingly, a lot of people see government failure and suggest we should just institutionalize it rather than try our best to do something about it.

- Cash for Clunkers is not good at creating jobs. This should surprise no one, I hope. Blinder's justification is that it gave the auto industry a boost at a very rough time. I suppose that's plausible, but it's awful fiscal stimulus.

- Jared Bernstein on the problem of the coincidence of market failure and government failure. Surprisingly, a lot of people see government failure and suggest we should just institutionalize it rather than try our best to do something about it.

- Cash for Clunkers is not good at creating jobs. This should surprise no one, I hope. Blinder's justification is that it gave the auto industry a boost at a very rough time. I suppose that's plausible, but it's awful fiscal stimulus.

Professional whereabouts/updates

Interesting stuff going on.

First, both my Review of Black Political Economy article with Marla McDaniel and my Journal of Economic Behavior and Organization article with Signe-Mary McKernan and Caroline Ratcliffe are out as of this week. They've been online for a little while, but it's always nice to see the issue come out.

Second, I'll be at two conferences this week. I'll be presenting my job creation tax credit work at the Society for Government Economists meeting on Wednesday. The plan is to revamp this paper in the spring to get it in its final form as a dissertation chapter. Then on Friday I'll be chairing and presenting on a high skill immigration panel at the Association for Public Policy Analysis and Management conference. The first conference is relatively small, but the latter is the major public policy scholarly association. I'll be talking about the F-1, the OPT, and the issues around connections between school and work for foreign students with particular reference to the H-1B.

Finally, an interesting development is that I've picked up some contract work from the National Academy of Engineering looking at the engineering technicians and technologists labor market. Most of the work will be in the spring - should be interesting.

First, both my Review of Black Political Economy article with Marla McDaniel and my Journal of Economic Behavior and Organization article with Signe-Mary McKernan and Caroline Ratcliffe are out as of this week. They've been online for a little while, but it's always nice to see the issue come out.

Second, I'll be at two conferences this week. I'll be presenting my job creation tax credit work at the Society for Government Economists meeting on Wednesday. The plan is to revamp this paper in the spring to get it in its final form as a dissertation chapter. Then on Friday I'll be chairing and presenting on a high skill immigration panel at the Association for Public Policy Analysis and Management conference. The first conference is relatively small, but the latter is the major public policy scholarly association. I'll be talking about the F-1, the OPT, and the issues around connections between school and work for foreign students with particular reference to the H-1B.

Finally, an interesting development is that I've picked up some contract work from the National Academy of Engineering looking at the engineering technicians and technologists labor market. Most of the work will be in the spring - should be interesting.

Wednesday, October 30, 2013

The importance of the context provided by the history of economic thought

Many of my students were a little confused in my class on "modern Smithians" when we talked about Romer and Krugman's work on growth and trade theory, respectively, as being two of the preeminent examples of modern Smithian economics. They didn't see division of labor anywhere in either of those works - at least not obviously so.

We just got into neoclassicism yesterday, after having spent two classes on marginalism (neoclassicism, for these purposes, effectively covered the marginalists after the marginal revolution). In the intervening weeks they learned about how Smithian productive efficiencies quickly gave way to diminishing returns in Malthus and Ricardo. Both of these economists used diminishing returns because it was plausible, but also because it provided a stable solution to the problems they were considering: population and rent.

We left that aside for a couple weeks working through Mill and Marx, but then came back to these assumptions when we started into the marginalists. Mixing together primary sources, some standard intermediate micro problems, and out history of thought text the importance of diminishing returns really started to crystalize for them.

Then in steps Marshall and others who applied these tools to problems of interest. Marshall tells one particular story using the language of marginalism, but it's a story about how some industrial districts seem to be characterized by increasing returns. Assume spillovers. Assume nice pinned down firm behavior with the activity of other firms bleeding over into each others' cost functions. Now we have a case that bucks the trend of diminishing returns we've been seeing week after week after week. Smith was so nice and positive - Malthus and Ricardo were both downers. And here comes Marshall with a happy result again that is very reminiscent of Smith.

Where have we heard something like this before? I asked.

And then several students' eyes lit up. That's why Krugman and Romer made a big splash. It seemed so different from Smith at the time because the story was in a different language, but after trudging through Malthus, Ricardo, Mill, and the marginalists and understanding the importance of the increasing/diminishing returns divide, Marshall's spillovers seemed refreshingly Smithian. It's not just increasing returns either, it's the idea that productivity goes up with densely populated areas too.

Anyway, this connect the dots exercise is obvious for economists. But if you've read a little Smith on the division of labor and you don't have the context of the next hundred years of economic thought it's not exactly clear why I said what I said earlier in the course.