In my forthcoming discussion of ABCT (actually I'm careful to say

Hayek's business cycle theory because there are a lot of ABCTs), the editor unfortunately cut out a parenthetical prod I had in there. After discussing Sraffa's criticism of Hayek on the natural rate, as well as Robert Murphy's discussion of that I conceded the technical point to Murphy and Hayek (and Conrad and Lachmann), but then suggested that it's not a real problem for ABCT and that at most it obligates Austrians to be careful not to talk too casually about natural rates. I wrapped that up by saying "(few besides the odd Sraffian or Post-Keynesian are bound to call them out on it anyway)".

Well, a Sraffian/Post Keynesian

has called them out on it recently and my reaction is again - meh. LK discussed the problems around talking about the natural rate along with several other points yesterday, which Jonathan Catalan

ably responded to. I think Jonathan is right - LK is nitpicking about the fact that an abstract model is an abstraction but none of them seem to cut to the heart of ABCT. Nobody thinks, I hope, that ABCT or any economic model perfectly replicates the way that the economy actually works. They're all simple stories.

Wicksellian natural rates, loanable funds theory, equilibrium, full employment assumptions (of course in

Profits, Interest, and Investment Hayek drops the full employment assumption, which shows you how important that is to the results), and flexible prices all come in for criticism from LK. And who can argue with the criticisms? But where does that really get us?

If prices are inflexible it may dull the unsustainable boom and the bust and may make us less sanguine about full recovery. So? Does it eliminate the Austrian business cycle? Not that I can tell.

On loanable funds, it's absolutely not a complete interest rate theory but is it a contentless theory of interest rates? Of course not. Holding liquidity preference constant demand for loanable funds is definitely going to move interest rates! It's still an operable factor in that market so the Austrian concerns still hold. Now could we say "

this will make us less sure that the absence of central bank intervention is going to make everything OK" as a result of our mistrust of pure loanable funds theory? Definitely. But that hardly makes the theory "unsound" (LK's words) except in a very trivial sense.

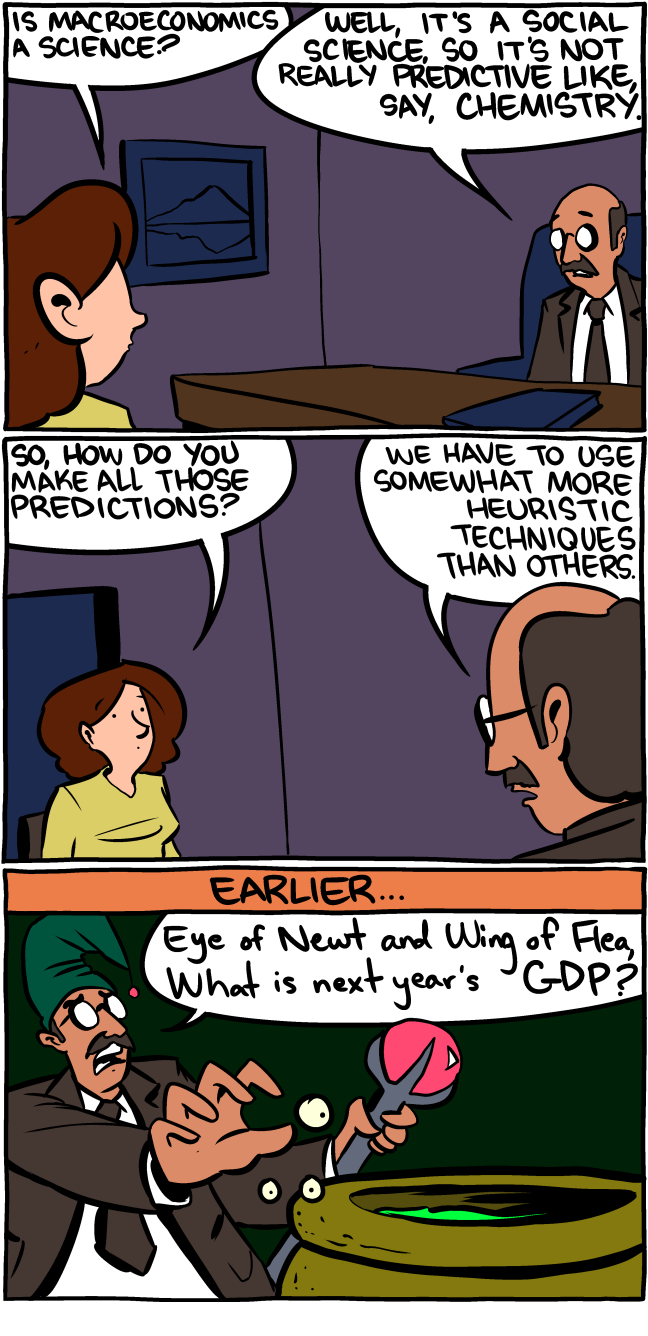

Models are descriptions of mechanisms, not full blown replicas of economies. Does ABCT highlight a mechanism worth talking about? Yes, I think. And the scant empirical research shows that the length of the capital structure does seem to be pro-cyclical which also suggests the Austrians are highlighting an important mechanism.

A much more reasonable avenue for criticizing Austrian theory is not in nitpicking the modeling assumptions. The model does it's job fine - it illustrates an interesting mechanism. That's it's

only job. We should instead be criticizing Austrian theory on the basis of how it does explaining the major causes of crises. The recent crisis doesn't seem to have anything to do with the unsustainability of an elongated capital structure. It seems to have everything to do with an asset bubble that lead to a demand shock. We could just say that ABCT isn't going to explain every crisis and that's fine, but that's one mark against ABCT and it matters a lot more than the criticisms LK raises. We could also point out the relationship between interest rates and estimates of the natural rate (for example, Laubach and Williams's estimates), and then we'd see that the looseness/tightness of monetary policy doesn't really follow patterns you would expect if ABCT were intelligible. There are lots of other, much stronger, critiques along these lines.

In total, they suggest to me that ABCT probably isn't the best way forward (although Austrian capital theory comes out better). But it's a very different sort of argument from LKs.

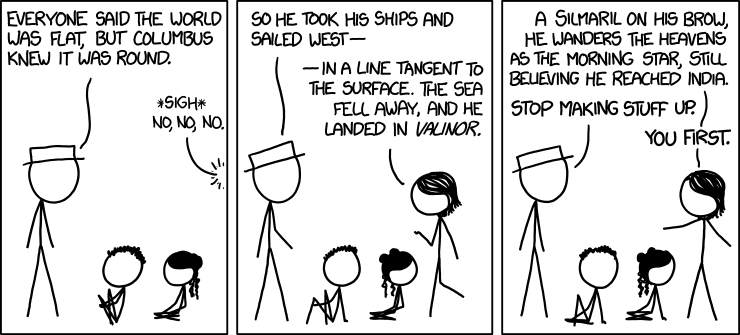

I personally don't understand this mentality that nit-picks at modeling assumptions. In LKs defense he doesn't usually do it to too great an extent. But it's the sort of stuff you see from Keen, Syll, and Pilkington among the Post Keynesians and Boettke on the Austrian side (surely others but he comes to mind most prominently). It's a strong heterodox tradition but I personally think it's rather weak and misses the point of models. I am looking for a good idea of how the world works, and then I'm looking to go out and see if the world actually works something like that. If a model succeeds in communicating that mechanism to me, it's done its job just fine. Models that claim more for themselves need to be more careful on foundational assumptions, of course.