In the last post I noted that monopsony is definitely not the only and not even really the best theoretical argument for why we see no disemployment effects. Commenters made this point too, including YouNotSneaky, who regularly highlights the limits of the dynamic monopsony model as an explanation. (S)he is correct that dynamic monopsony is not sufficient and does not automatically imply that a minimum wage will raise employment, but my standard is somewhat different than that. None of these explanations automatically imply anything, the question is whether they seem to be plausible explanations. We have work that suggests there is monopsony power in low wage labor markets, and we know that under certain conditions (but not all conditions) dynamic monopsony can explain the no disemployment effect result, so it seems reasonable to me to keep it on the table.

I'm not a theory guy so it would take some time to review and walk through the models, but there's plenty of material out there if you're looking for the conditions under which monopsony does and doesn't provide this result. Manning runs simulations on his model with Dickens and Machin on pages 340-347 in Monopsony in Motion and shows what parameters produce a no disemployment result and which ones produce a big disemployment effect. Critically, none of them show much of an effect when the minimum wage shock is small. Bhaskar and To (1999) have similar "it depends on the parameters" results, as do a few other papers. A lot of this doesn't just depend on the parameters but the source of the monopsony power itself. Search models seem to be more problematic for getting the result than product differentiation models (I noted both sources of market power in the prior post).

YouNotSneaky is particularly interested in what monopsony can definitively tell us. I come at it from the other direction: when I see good studies showing no disemployment effect my conclusion is that I have to accept monopsony (with the right parameters) as a decent candidate explanation to keep on the table.

I wanted to share a discussion of these issues from Manning's 2003 book on the subject that I think drives this perspective home:

Finally, I wanted to bring attention to a new post from Don (and apparently more are coming) that I think is much stronger than the prior posts. He notes that if we think that firms exercise market power over their workers they should be able to price discriminate. If they can price discriminate it gives them some latitude to continue to higher more workers at higher wages and approach the competitive wage level for those new workers. The price discrimination capacity here is key because if the workes who are paid at (or I suppose "near" will work) their reservation wages increase their wages too then it's not a profit maximizing move to hire new workers up to the competitive wage. I think this is a really good and reasonable point. I also find it interesting because it (I think - this is just off the top of my head) provides a nice explanation for the spike in the wage distribution at the minimum wage that Manning suggests is a puzzle to a number of different models. The logic would be that before the minimum wage increase there are a lot of people employed for less than their marginal product, they're kept on when the minimum wage goes into effect because the increase is still less than their marginal product, but they're all now bunched at the minimum wage level until the curves shift again and the distribution smooths out. I'm not 100% sure if this actually works out but it seems sensible.

Tuesday, August 18, 2015

Saturday, August 15, 2015

Frictions, Monopsony Power, and Entry

Don Boudreaux has written a long post challenging me by name on monopsony power and the minimum wage. I've addressed all the points in his comment section before, although he does not speak to those directly. Rather than bury responses in another one of Cafe Hayek's comment sections I thought I'd provide them here. I'd encourage people not to take Don's word for what my claims have been - he says I've made a lot of claims that I actually haven't. So if you don't read me claim something please confirm with me that I actually think it before attributing it to me!

The issue at hand is whether market entry can dissipate the monopsony power that is often cited as a reason why we don't see big disemployment effects associated with the minimum wage. Don has repeatedly asserted that people who don't think there are major disemployment effects should go out and hire a bunch of underpaid workers. They would enrich themselves and help low income workers. If they're not willing to do this, Don actually suggests that is evidence in and of itself against the empirical work! There are some obvious problems with this challenge, and Don seems to assume that entrepreneurship is a simple affair (he calls it "easy"). I disagree, but let's leave those issues aside. The question is, would mere entry even have any impact on the sort of frictions that we think cause monopsony power? I don't think so. If that was all it took, we wouldn't see much evidence of monopsony power. I'm going to tackle this in three parts: First, the nature of the frictions people normally point to, second examples of precisely what Don is looking for and what we expect from market entry, and third other sources of the disemployment result.

1. Frictions

Don't consider this an exhaustive list, but when we're thinking of the low wage labor market a lot of the frictions I generally have in mind are (1.) hiring and firing costs, (2.) asymmetric information about the worker's productivity, (3.) firm-specific human capital, and (4.) liquidity constraints and various other factors that make search costly for a low income worker. Competitive pressure from entry is extraordinarily important in the market process but merely entering a market doesn't obviously address these frictions. If I provide more demand for low wage workers I've done nothing to change the fact that the current employer of a high productivity low wage workers has private information about that worker's productivity that I don't have. Although this is less related to monopsony power, I also haven't done anything to change the asymmetric information between me and the worker herself about her productivity. In a sense you can think of the labor market (any labor market, not just the low wage labor market) as a market for lemons. Entry in the market for lemons does not fundamentally change the problem (neither, for that matter, does imposing a minimum price). The same goes for hiring and firing costs. Competition of course grinds down all costs to some extent but it doesn't change the fact that employment is going to be associated with fixed costs, and as Walter Oi pointed out decades ago (at the start of this dynamic monopsony literature) fixed costs associated with labor lead to workers being paid lower than their marginal product (similar insights structure Gary Becker's work on human capital). Firm specific human capital also gives your employer some control over you. Your know-how developed on-the-job is partly general but much of it is also specific to your employer. And again, if a competitor wants to make you equally productive they're going to have to make their own (fixed cost) investments in you.

A lot of this has focused on the relationship with the employer, but workers in general - and low wage workers in particular - often face search frictions that contribute to their employer's monopsony power. Search is costly and it's particularly costly if you're a low wage worker. These workers face liquidity constraints, many are young and supporting families, and transportation limitations are likely to raise the costs of search. All of this reduces separation rates and contributes to an incumbent employer's monopsony power.

Don is presenting a very naive/classic understanding of market power where it's purely a numbers game. Market power is caused by sparse markets under this view, so entry should solve the problem. I don't think this cuts it. For a long time - really going back to Edward Chamberlin at least - economists have understood that firms, products, workers, capital, etc. are not homogenous or undifferentiated entities. Product differentiation provides market power even when there are many firms in the market. The same goes with workers. The heterogeneity of labor leads to many of the asymmetric information problems I highlighted above. In these monopolistic and monopsonistic competition situations additional competition of course erodes market power, but it does not eliminate it. These are not just abstract theories - workers and capital really are heterogeneous and differentiated. When we do price theory, we can't just ignore that and construct more convenient models that don't acknowledge it.

What might matter more for eroding monopsony power is entrepreneurship targeted at the sources of monopsony power. Innovation and entrepreneurship in private accreditation or other methods for revealing more information about workers' productivity or for connecting employers to workers could help. But mere entry into a market that employs low wage workers doesn't have any obvious benefits unless we simply have charity in mind (which is not Don's point).

2. What to expect from entry and paying higher wages

The ironic thing is we see examples of what Don is demanding in the news all the time. He seems so fixated on Paul Krugman (and, weirdly, me) that he doesn't seem interested in these cases as evidence. Costco, Wal-Mart recently, Trader Joe's, In-N-Out Burger, etc. are all regularly cited as doing what Don suggests. I think an interesting exercise would be to look into their hiring process because they may be innovating along the margins I've mentioned above. Another possibility is that these firms may be on a higher equilibrium in a multiple equilibrium. Labor economists often note important interactions between turnover and productivity that allow for the co-existence of low-turnover, high productivity and high-turnover, low productivity firms that are both profitable but at different equilibria. In any case, these are clear examples of what Don is looking for.

I think when we think about entry it's important to remember that competitive pressure and entry threat is always operating and always pushing markets toward their equilibrium point - that's the market process - but there's no necessary reason for that to be a "competitive equilibrium" as it's defined by economists. Competitive pressures could push firms toward an equilibrium with market power too. In a sense it's unfortunate that the word "competitive" is even used to describe these cases, since competition is in play in all markets. Nomenclature often fails us, but that's no excuse for bad analysis.

3. Other arguments besides monopsony

So one thing that bugs me about Don's post is this line: "Mr. Kuehn implicitly asks us simply to assume that the studies that he favors do in fact capture and accurately measure all of these aspects of the employment arrangements or contracts of low-skilled workers. But, in reality, there is good reason to reject Mr. Kuehn's implicit claim". Why does Don keep using the word "implicit"? Because he's making things up and knows he can't say that I ever actually claimed it. There are a lot of options besides monopsony for explaining the empirical results, and there's a lot of work left to do to figure all this out. One of them is other margins of adjustment besides employment. This is central to the work on the minimum wage in Berkeley - both the arguments they've provided to date and the work they're doing now (Michael Reich, of Dube, Lester, and Reich (2010) fame, asked me to apply to a post-doc at Berkeley to study precisely these alternative margins of adjustment - I declined because I've got plenty of work here and am very happy with it). Instead of adjusting the employment margin, firms may reduce other benefits or increase prices or reduce turnover (to cut Walter Oi's fixed costs). These are different from the monopsony argument but not unrelated (for example, they have a turnover margin of adjustment to work on precisely because they have monopsony power). In some ways I actually prefer these arguments, although I imagine all are in play. In the only published work I've ever done on the minimum wage I'm pretty straightforward about it and I haven't ever said monopsony is the only game in town. This is what I wrote in my EPI paper:

"There are many different explanations for the lack of substantial disemployment effects in matching studies. One suggestion is that employers exercise “monopsony power,” or bargaining power associated with being one of a small population of buyers in a market (an analog to the monopoly power exercised by sellers). Just as a monopoly will not reduce its output in response to an imposed price reduction, a monopsonist can absorb a price increase (such as a minimum-wage increase) without reducing demand for workers. Although such theoretical explanations are possible, a more straightforward argument is that an increase in the minimum wage does not have a disemployment effect because the increased labor costs are easily distributed over small price or productivity increases, or because fringe benefits are cut instead of employment levels. Less work has been done on the impact of the minimum wage on these outcomes than on the employment impact. Alternatively, disemployment effects might be avoided due to reduced fixed hiring costs as a result of lower turnover."

The issue at hand is whether market entry can dissipate the monopsony power that is often cited as a reason why we don't see big disemployment effects associated with the minimum wage. Don has repeatedly asserted that people who don't think there are major disemployment effects should go out and hire a bunch of underpaid workers. They would enrich themselves and help low income workers. If they're not willing to do this, Don actually suggests that is evidence in and of itself against the empirical work! There are some obvious problems with this challenge, and Don seems to assume that entrepreneurship is a simple affair (he calls it "easy"). I disagree, but let's leave those issues aside. The question is, would mere entry even have any impact on the sort of frictions that we think cause monopsony power? I don't think so. If that was all it took, we wouldn't see much evidence of monopsony power. I'm going to tackle this in three parts: First, the nature of the frictions people normally point to, second examples of precisely what Don is looking for and what we expect from market entry, and third other sources of the disemployment result.

1. Frictions

Don't consider this an exhaustive list, but when we're thinking of the low wage labor market a lot of the frictions I generally have in mind are (1.) hiring and firing costs, (2.) asymmetric information about the worker's productivity, (3.) firm-specific human capital, and (4.) liquidity constraints and various other factors that make search costly for a low income worker. Competitive pressure from entry is extraordinarily important in the market process but merely entering a market doesn't obviously address these frictions. If I provide more demand for low wage workers I've done nothing to change the fact that the current employer of a high productivity low wage workers has private information about that worker's productivity that I don't have. Although this is less related to monopsony power, I also haven't done anything to change the asymmetric information between me and the worker herself about her productivity. In a sense you can think of the labor market (any labor market, not just the low wage labor market) as a market for lemons. Entry in the market for lemons does not fundamentally change the problem (neither, for that matter, does imposing a minimum price). The same goes for hiring and firing costs. Competition of course grinds down all costs to some extent but it doesn't change the fact that employment is going to be associated with fixed costs, and as Walter Oi pointed out decades ago (at the start of this dynamic monopsony literature) fixed costs associated with labor lead to workers being paid lower than their marginal product (similar insights structure Gary Becker's work on human capital). Firm specific human capital also gives your employer some control over you. Your know-how developed on-the-job is partly general but much of it is also specific to your employer. And again, if a competitor wants to make you equally productive they're going to have to make their own (fixed cost) investments in you.

A lot of this has focused on the relationship with the employer, but workers in general - and low wage workers in particular - often face search frictions that contribute to their employer's monopsony power. Search is costly and it's particularly costly if you're a low wage worker. These workers face liquidity constraints, many are young and supporting families, and transportation limitations are likely to raise the costs of search. All of this reduces separation rates and contributes to an incumbent employer's monopsony power.

Don is presenting a very naive/classic understanding of market power where it's purely a numbers game. Market power is caused by sparse markets under this view, so entry should solve the problem. I don't think this cuts it. For a long time - really going back to Edward Chamberlin at least - economists have understood that firms, products, workers, capital, etc. are not homogenous or undifferentiated entities. Product differentiation provides market power even when there are many firms in the market. The same goes with workers. The heterogeneity of labor leads to many of the asymmetric information problems I highlighted above. In these monopolistic and monopsonistic competition situations additional competition of course erodes market power, but it does not eliminate it. These are not just abstract theories - workers and capital really are heterogeneous and differentiated. When we do price theory, we can't just ignore that and construct more convenient models that don't acknowledge it.

What might matter more for eroding monopsony power is entrepreneurship targeted at the sources of monopsony power. Innovation and entrepreneurship in private accreditation or other methods for revealing more information about workers' productivity or for connecting employers to workers could help. But mere entry into a market that employs low wage workers doesn't have any obvious benefits unless we simply have charity in mind (which is not Don's point).

2. What to expect from entry and paying higher wages

The ironic thing is we see examples of what Don is demanding in the news all the time. He seems so fixated on Paul Krugman (and, weirdly, me) that he doesn't seem interested in these cases as evidence. Costco, Wal-Mart recently, Trader Joe's, In-N-Out Burger, etc. are all regularly cited as doing what Don suggests. I think an interesting exercise would be to look into their hiring process because they may be innovating along the margins I've mentioned above. Another possibility is that these firms may be on a higher equilibrium in a multiple equilibrium. Labor economists often note important interactions between turnover and productivity that allow for the co-existence of low-turnover, high productivity and high-turnover, low productivity firms that are both profitable but at different equilibria. In any case, these are clear examples of what Don is looking for.

I think when we think about entry it's important to remember that competitive pressure and entry threat is always operating and always pushing markets toward their equilibrium point - that's the market process - but there's no necessary reason for that to be a "competitive equilibrium" as it's defined by economists. Competitive pressures could push firms toward an equilibrium with market power too. In a sense it's unfortunate that the word "competitive" is even used to describe these cases, since competition is in play in all markets. Nomenclature often fails us, but that's no excuse for bad analysis.

3. Other arguments besides monopsony

So one thing that bugs me about Don's post is this line: "Mr. Kuehn implicitly asks us simply to assume that the studies that he favors do in fact capture and accurately measure all of these aspects of the employment arrangements or contracts of low-skilled workers. But, in reality, there is good reason to reject Mr. Kuehn's implicit claim". Why does Don keep using the word "implicit"? Because he's making things up and knows he can't say that I ever actually claimed it. There are a lot of options besides monopsony for explaining the empirical results, and there's a lot of work left to do to figure all this out. One of them is other margins of adjustment besides employment. This is central to the work on the minimum wage in Berkeley - both the arguments they've provided to date and the work they're doing now (Michael Reich, of Dube, Lester, and Reich (2010) fame, asked me to apply to a post-doc at Berkeley to study precisely these alternative margins of adjustment - I declined because I've got plenty of work here and am very happy with it). Instead of adjusting the employment margin, firms may reduce other benefits or increase prices or reduce turnover (to cut Walter Oi's fixed costs). These are different from the monopsony argument but not unrelated (for example, they have a turnover margin of adjustment to work on precisely because they have monopsony power). In some ways I actually prefer these arguments, although I imagine all are in play. In the only published work I've ever done on the minimum wage I'm pretty straightforward about it and I haven't ever said monopsony is the only game in town. This is what I wrote in my EPI paper:

"There are many different explanations for the lack of substantial disemployment effects in matching studies. One suggestion is that employers exercise “monopsony power,” or bargaining power associated with being one of a small population of buyers in a market (an analog to the monopoly power exercised by sellers). Just as a monopoly will not reduce its output in response to an imposed price reduction, a monopsonist can absorb a price increase (such as a minimum-wage increase) without reducing demand for workers. Although such theoretical explanations are possible, a more straightforward argument is that an increase in the minimum wage does not have a disemployment effect because the increased labor costs are easily distributed over small price or productivity increases, or because fringe benefits are cut instead of employment levels. Less work has been done on the impact of the minimum wage on these outcomes than on the employment impact. Alternatively, disemployment effects might be avoided due to reduced fixed hiring costs as a result of lower turnover."

Sunday, May 17, 2015

Don Boudreaux seems to pick and choose his view on average product and wages depending on what the liberal du jour is arguing

Recently, Don Boudreaux called Robert Reich sophomoric for suggesting that productivity (as the BLS measures it) and real wages should move in tandem. Even an intro student could tell you that wages are determined by workers' marginal product, not their average product! The conclusion:

"It, and it alone, should label him forever as someone not to be trusted to analyze any economic matter, including the economics of minimum-wage legislation."

Strong words coming from a guy that just a year ago (in an op-ed written with grad student Liya Palagashvili) was adamant that we should expect from theory that the market "links pay to productivity," which throughout the op-ed is the same BLS measured average product that Reich is referring to!

My view is this:

2015 Don is right about theory.

2014 Don and Liya are right about empirics.

This combination is a point in favor NOT of the idea that wages are determined by average products, but of the idea that the production function is something like Cobb-Douglas. When accounting for all compensation (not just wages) the labor share stays fairly constant and when accounting for compensation and deflating the nominal figures correctly average product grows with wages (which are equal to marginal product). These are both properties of a Cobb Douglas production function (although Bob Murphy has a really nice post on how other functional forms could produce a divergence between average product and wages that many people allege is happening).

"It, and it alone, should label him forever as someone not to be trusted to analyze any economic matter, including the economics of minimum-wage legislation."

Strong words coming from a guy that just a year ago (in an op-ed written with grad student Liya Palagashvili) was adamant that we should expect from theory that the market "links pay to productivity," which throughout the op-ed is the same BLS measured average product that Reich is referring to!

My view is this:

2015 Don is right about theory.

2014 Don and Liya are right about empirics.

This combination is a point in favor NOT of the idea that wages are determined by average products, but of the idea that the production function is something like Cobb-Douglas. When accounting for all compensation (not just wages) the labor share stays fairly constant and when accounting for compensation and deflating the nominal figures correctly average product grows with wages (which are equal to marginal product). These are both properties of a Cobb Douglas production function (although Bob Murphy has a really nice post on how other functional forms could produce a divergence between average product and wages that many people allege is happening).

Friday, May 8, 2015

I love this graph from Paul Krugman

I love this graph. When you just graph the monetary base you give the impression that the Fed is (1.) in complete control and (2.) very expansionary. It takes careful argument to walk people back from each of those impressions. Depending on who you're talking to you usually only get halfway through convincing them that the last one is not true and don't make much progress at all on the first one. Market monetarists are weirdos that get that the second one isn't true but maintain adamantly that the first one is true - practically tautologically in some cases. When you put M2 over the base it makes clear why the second one isn't true and strongly suggests that the first one isn't true either (unless you think there was some radical change in preferences on the part of the Fed at the beginning of the recession).

Tuesday, April 28, 2015

Brief reaction to Baltimore

My thoughts are with Baltimore tonight. The last time the governor

called the National Guard out to respond to riots my dad was able to get

out to his grandfather's farm in Baltimore County. Not everyone has

that option, then or now. That governor was Spiro Agnew, fwiw. Soon

afterward he got a VP slot on Nixon's ticket for his tough law and order

stance. My great grandfather's constitutional convention vote failed

shortly after too in part because it was perceived as too liberal

and reapportioned too much power to Baltimore city and the DC suburbs.

I've come across mixed reactions but some delegates think racial

tensions and the riot killed it.

Will Hogan be a VP? Probably not. And chances are that this will accelerate some reforms. But the riots sure didn't put Baltimore on a strong trajectory in 1968 and they're nothing but bad news now. I wish both the cops and the rioters well. I've already seen some celebration of harsh crackdowns, though. Hopefully this settles down quickly because escalation of any sort will not be for the better. Citizens' responsibility is to fight for justice and speak truth to power. Police and National Guard responsibility is to protect and serve. We need a great deal of both, I think.

Will Hogan be a VP? Probably not. And chances are that this will accelerate some reforms. But the riots sure didn't put Baltimore on a strong trajectory in 1968 and they're nothing but bad news now. I wish both the cops and the rioters well. I've already seen some celebration of harsh crackdowns, though. Hopefully this settles down quickly because escalation of any sort will not be for the better. Citizens' responsibility is to fight for justice and speak truth to power. Police and National Guard responsibility is to protect and serve. We need a great deal of both, I think.

Thursday, April 23, 2015

David Henderson on Barbara Bergmann and the wage gap

I wanted to highlight this post by David Henderson on the late Barbara Bergmann, much of which is a discussion of her writing on the wage gap. He promises more to come.

One of the things I like about this post is that it shows how both sides have to be careful with wage regression interpretations when talking about the wage gap. David's criticisms of Barbara are very much along the same lines as my criticisms of guys like Mark Perry. (I am not deeply knowledgeable about what she's written on it, so to a certain extent I'm taking David's word on it but it's a very common way of talking about things).

While I'm posting more on her, I'll also point out that Taylor and Francis is providing free access to a special issue of Feminist Economics on Barbara Bergmann this month. So download those pdfs before it's too late!

One of the things I like about this post is that it shows how both sides have to be careful with wage regression interpretations when talking about the wage gap. David's criticisms of Barbara are very much along the same lines as my criticisms of guys like Mark Perry. (I am not deeply knowledgeable about what she's written on it, so to a certain extent I'm taking David's word on it but it's a very common way of talking about things).

While I'm posting more on her, I'll also point out that Taylor and Francis is providing free access to a special issue of Feminist Economics on Barbara Bergmann this month. So download those pdfs before it's too late!

Tuesday, April 7, 2015

Does anybody have experience with a distributed lag model for panel data?

Does anybody have experience with a distributed lag model for a panel dataset? I'm getting this odd result where I'm trying a bunch of different lag lengths and no matter what I run the two longest lags have much bigger coefficients than the rest. So when I run with six lags, five and six have big coefficients but when I run with sixteen lags fifteen and sixteen do. I feel like this has to indicate something about the data structure and the model - it can't be real to always show that no matter what the lag length. I'm just not sure what it indicates.

If it matters - I'm looking at size of apprenticeship programs in an unbalanced panel with lags of the unemployment rate. No lags of the dependent variable.

Data adjustments - not a conspiracy, just a part of empirical work in economics

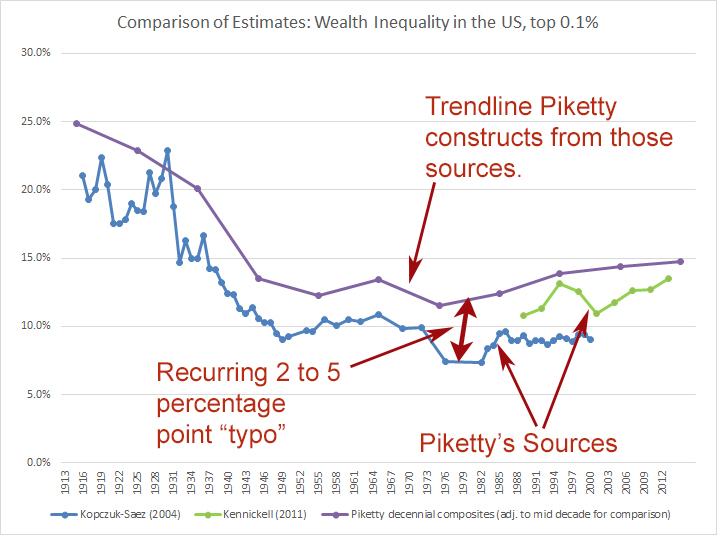

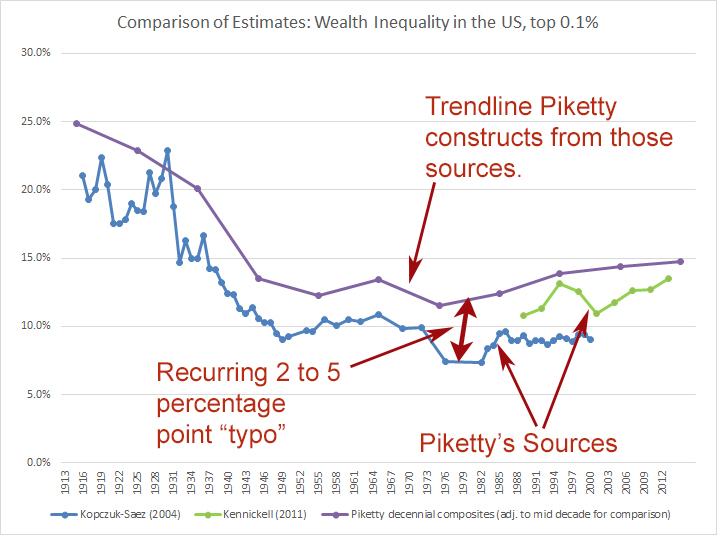

I got an email today announcing an Urban seminar, and the abstract reminded me of some of the Piketty debates around Bob Murphy and Phil Magness's paper and subsequent discussions. Here it is:

The CPS is typically not used to address inequality for all sorts of reasons, including the nature of the questions, coverage, and top-coding. But it still has income questions, and note that a recent redesign changes asset income reports. Of course if we were to use the CPS to think about some of Piketty's research questions, this change would be important. Moreover, if you wanted to use a consistent series from the CPS you would have to adjust the data to either move down the newer half of the series, or (probably preferably if this redesign represents an improvement) moving up the older half of the series. They do split samples discussed in the abstract so that you can understand the sort of adjustment that might be appropriate.

This is what Piketty is doing too when he harmonizes several of the wealth inequality series, and he uses years when the data series overlap to develop the adjustment factors. The figure Murphy and Magness like to call the "Frankenstein graph" suggests that certain blocks of the series come from different datasets, but in reality Piketty is typically taking data from several datasets to provide a harmonized estimate (for example, combining the Kopczuk and Saez data and the SCF data). This is how you'd want to merge several datasets, and it's generally not "pivoting" between datasets or "overstating" them as Murphy and Magness put it.

Anyone can criticize these sorts of data decisions, but it's a normal part of empirical work. If your criticism is just that the data decisions result in the conclusion that Piketty draws, that's not a very reasonable criticism. It's entirely circular: Piketty's conclusions are bad because his data decisions are bad. How do you know his data decisions are bad? Because they correspond to his conclusions!

"ABSTRACT: The 2014 Current Population Survey, Annual Social and Economic Supplement (CPS-ASEC) introduced major changes to the income questions. The questions were introduced in a split-sample design—with 3/8 of the sample asked the new questions and 5/8 asked the traditional questions. Census Bureau analysis of the 3/8 and 5/8 samples finds large increases in retirement, disability, and asset income and modest increases in Social Security and public assistance benefits under the new questions. However, despite the additional income, poverty rates are higher for children and the elderly in the sample asked the new questions. In this brownbag, we discuss the changes to the survey, the effects of the changes on retirement and other income, and describe how compositional differences among families with children in the 3/8 and 5/8 samples may explain the unexpectedly higher poverty rates in the 3/8 sample. The discussion has practical as well as theoretical importance, as researchers will have a choice of datasets to choose from when analyzing the 2014 CPS-ASEC data—the 3/8 sample weighted to national totals, the 5/8 sample weighted to national totals, a combined sample, and possibly also an additional file prepared by the Census Bureau that imputes certain income data to the 5/8 sample based on responses in the 3/8 sample."

The CPS is typically not used to address inequality for all sorts of reasons, including the nature of the questions, coverage, and top-coding. But it still has income questions, and note that a recent redesign changes asset income reports. Of course if we were to use the CPS to think about some of Piketty's research questions, this change would be important. Moreover, if you wanted to use a consistent series from the CPS you would have to adjust the data to either move down the newer half of the series, or (probably preferably if this redesign represents an improvement) moving up the older half of the series. They do split samples discussed in the abstract so that you can understand the sort of adjustment that might be appropriate.

This is what Piketty is doing too when he harmonizes several of the wealth inequality series, and he uses years when the data series overlap to develop the adjustment factors. The figure Murphy and Magness like to call the "Frankenstein graph" suggests that certain blocks of the series come from different datasets, but in reality Piketty is typically taking data from several datasets to provide a harmonized estimate (for example, combining the Kopczuk and Saez data and the SCF data). This is how you'd want to merge several datasets, and it's generally not "pivoting" between datasets or "overstating" them as Murphy and Magness put it.

Anyone can criticize these sorts of data decisions, but it's a normal part of empirical work. If your criticism is just that the data decisions result in the conclusion that Piketty draws, that's not a very reasonable criticism. It's entirely circular: Piketty's conclusions are bad because his data decisions are bad. How do you know his data decisions are bad? Because they correspond to his conclusions!

Saturday, March 14, 2015

Fairness and policy

In the last sentence of the last post I alluded to the fact that things get more complicated when we move from caring about inequality to doing something about inequality. You can obviously never just use "fairness" to justify a policy solution not just because ends don't justify means (you have to know something about the ethics of the solution) but also because you have to demonstrate that there aren't other attendant ends that you don't want. A simple example is communism. We can dispute communism because the ends don't justify the means - the goal of equality does not justify violating property rights. But we can also dispute it on the grounds that in addition to making everyone equal it makes them miserable and poorer than they otherwise would be.

This is very much a "no duh" point. A sense of fairness doesn't in and of itself tell you how to respond - certainly not in the case of policy and likely not in your own capacity either. But it reminds me of what I think is a more interesting point from Rawls on the limits of "fairness" as a moral framework and the real utility of fairness as a way of approaching political questions and really questions of social organization generally. It is an old point about tolerance and liberalism, but it draws the connection between tolerance and Rawlsian fairness. This is from "Justice as Fairness: Political not Metaphysical":

This is very much a "no duh" point. A sense of fairness doesn't in and of itself tell you how to respond - certainly not in the case of policy and likely not in your own capacity either. But it reminds me of what I think is a more interesting point from Rawls on the limits of "fairness" as a moral framework and the real utility of fairness as a way of approaching political questions and really questions of social organization generally. It is an old point about tolerance and liberalism, but it draws the connection between tolerance and Rawlsian fairness. This is from "Justice as Fairness: Political not Metaphysical":

Friday, March 13, 2015

Why inequality matters

The last twelve months have really been The Year of Inequality. It started with the English translation of Piketty's book and it has taken over the political agenda. Over the last year I've regularly heard too odd critiques of the preoccupation with inequality:

1. Inequality doesn't matter, poverty does

2. Inequality only matters if it comes through corruption, and in that case it's just a symptom

Obviously both have a kernel of truth. Poverty matters a lot. We have been studying the "wealth of nations" for 250 years because poverty is critically important. We also rarely believe that it would be unfair for everyone to earn the same income. That point goes back to Aristotle at least. What matters is illegitimate inequality, and this is the sentiment that the second objection tries to piggy-back on.

However, caring about poverty and corruption does not eliminate the case for concern about inequality that does not arise from corruption in a relatively wealthy society (e.g., most of the inequality Piketty writes about). We care about inequality because (1.) of our sense of fairness, and (2.) the fact that opportunities or capacities are unevenly distributed independent of any additional corruption that may exacerbate inequality further. As I write this it seems like a basic point. It feels a little silly to even make it. But I've seen both of the above objections with such frequency that I feel like I have to.

So does dealing with this sort of inequality violate Aristotle's principle that the worst form of inequality is making unequal things equal (not that we are obligated to care of course)? It may, but it may not. There are two big problems with Aristotle's principle as I see it (I'm almost certainly reinventing the wheel here - I didn't take much philosophy so you can fill in the details if I am). First, I don't see why any ethical significance attaches to natural and/or random endowments of capacity or opportunity (if random shocks are a random draw by Nature, these can be considered together). I should hope this was obvious from about the time the words left Aristotle's mouth. In fact I should hope a couple sentences down he notes this and it just doesn't get quoted as much.

The second reason why applications of Aristotle's principle are tricky is particularly relevant to Piketty and a capitalist economy: these systems are recursive and intergenerational, so one period's outcomes are the next period's opportunities. That's really the whole point of capital of course - it endures through periods of time and is productive in future periods. How do we think about Aristotle's principle in a recursive system? Is redistributing capital "making unequal things equal" or is failing to redistribute capital "making equal things unequal"? This is tricky enough in one generation because you have to distinguish between effort and luck of birth (assuming you agree with my first point that no ethical significance attaches to natural or random endowments of capacity or opportunity and therefore that redistribution in favor of those born into very unlucky circumstances is permissible). It gets very hard indeed when we move beyond one generation, because the choices of parents become the endowments of children.

Poverty obviously matters but a basic sense of fairness justifies caring about this even in a rich, uncorrupt society.

What we do about it of course compounds the difficulties for a number of well understood reasons having to do with behavioral responses.

Friday, February 27, 2015

John Taylor has one of the weirdest applications of Friedman's plucking model that I've ever seen

This is the weirdest application of Friedman's plucking model I've ever seen. Friedman did not show deep recessions can't have slow recoveries, he showed that the magnitude of the recovery is correlated with the magnitude of the crash and not vice versa (which is an argument against "cycle theories" where the reverse is true).

And as far as I know no one claims that deep recessions have to have slow recoveries (what Taylor claims Friedman demonstrated was false). What they claim is that recessions caused by financial crises are both deep and have slow recoveries. In the past when Taylor has made this point he's qualified that it's worse than other cases with financial crises - that may be true but it's quite different from what he's saying here.

Notice also the metric that he use (change in the employment to population ratio). It's not a bad thing to think about but it's worth looking at the long-run evolution of that metric. We were facing E/P headwinds before the Great Recession because the increase in female labor force participation was petering off and because of the aging population (the situation was very different on both fronts in the 80s). So it's a little misleading to compare the two periods on this metric.

And as far as I know no one claims that deep recessions have to have slow recoveries (what Taylor claims Friedman demonstrated was false). What they claim is that recessions caused by financial crises are both deep and have slow recoveries. In the past when Taylor has made this point he's qualified that it's worse than other cases with financial crises - that may be true but it's quite different from what he's saying here.

Notice also the metric that he use (change in the employment to population ratio). It's not a bad thing to think about but it's worth looking at the long-run evolution of that metric. We were facing E/P headwinds before the Great Recession because the increase in female labor force participation was petering off and because of the aging population (the situation was very different on both fronts in the 80s). So it's a little misleading to compare the two periods on this metric.

Thursday, February 26, 2015

Wage gaps and occupational coefficients: with a specific example from a commenter

I've said here before that in work I've done I've often used the word "disparity" rather than "discrimination" because "discrimination" confuses people - they think they know what it is, but it's a wishy-washy term. "Disparity" is broad but at least it's clear.

At Bob's blog I asked commenter Scott D to be more specific about what he meant by "discrimination" (how you interpret a wage regression can vary dramatically depending on how you conceptualize "discrimination"). His response is fine I think - a perfectly reasonable definition - and it's also a great opportunity to illustrate why I think people often misinterpret occupational coefficients in wage regressions. Scott D writes: "Discrimination in this context would constitute an error in decision-making. It would be a case of a worker’s real productivity being discounted irrationally, resulting in them losing out to another candidate with weaker credentials."

I think other people would have other definitions of discrimination but this is a great one. I'm willing to run with it.

So let's say a woman faces discrimination by this definition - she loses out to a man with weaker credentials. "Loses out" itself is pretty vague and could reasonably be consistent with several different observed labor market outcomes, two of which are:

Outcome A: She gets hired to the same job as the man but at lower pay, and

Outcome B: She doesn't get the job and instead takes her next best offer in a different occupation at lower pay. Let's further say that she is paid her real productivity in this job.

Let's say the woman's wage in Outcome A and the wage in Outcome B is exactly the same.

Under Outcome A, a wage regression with occupational dummies and a gender dummy is going reliably report the magnitude of the discrimination in the gender dummy. Under Outcome B, a wage regression with occupational dummies and a gender dummy is going to report all of the discrimination under the occupational dummies. If you interpret the results thinking that "discrimination" as Scott D defines it is only in the gender coefficient, you would say there is discrimination in the case of Outcome A, but that there's no discrimination in the case of Outcome B.

It would be one thing if these were very, very different sorts of discrimination but these are two reasonable outcomes from the exact same act of discrimination.

This is why people like Claudia Goldin see occupational dummies as describing the components of the wage gap and not as some way of eliminating part of the gap that isn't really about gender.

"Equal pay for equal work" is a principle that I should hope everyone can agree on. It's great stuff. And I for one think the courts might have some role to play in ensuring the principle is abided by in our society. But it's a pretty vacuous phrase when it comes to economic science. It's not entirely clear what it means or how it can be operationalized. Outcome A is clearly not equal pay for equal work, but what about Outcome B? After all the woman is being paid "fairly" for the work she ended up doing. Is that equal pay for equal work? You could make the argument but it doesn't feel right and in any case it's clearly incommensurate with the data analysis we're doing. When two things are incommensurate it's typically a good idea to keep them separate. Let "equal pay for equal work" ring out as a rallying call for a basic point of fairness and don't act like you can either affirm it or refute it with economic science. As far as I can tell you can't.

At Bob's blog I asked commenter Scott D to be more specific about what he meant by "discrimination" (how you interpret a wage regression can vary dramatically depending on how you conceptualize "discrimination"). His response is fine I think - a perfectly reasonable definition - and it's also a great opportunity to illustrate why I think people often misinterpret occupational coefficients in wage regressions. Scott D writes: "Discrimination in this context would constitute an error in decision-making. It would be a case of a worker’s real productivity being discounted irrationally, resulting in them losing out to another candidate with weaker credentials."

I think other people would have other definitions of discrimination but this is a great one. I'm willing to run with it.

So let's say a woman faces discrimination by this definition - she loses out to a man with weaker credentials. "Loses out" itself is pretty vague and could reasonably be consistent with several different observed labor market outcomes, two of which are:

Outcome A: She gets hired to the same job as the man but at lower pay, and

Outcome B: She doesn't get the job and instead takes her next best offer in a different occupation at lower pay. Let's further say that she is paid her real productivity in this job.

Let's say the woman's wage in Outcome A and the wage in Outcome B is exactly the same.

Under Outcome A, a wage regression with occupational dummies and a gender dummy is going reliably report the magnitude of the discrimination in the gender dummy. Under Outcome B, a wage regression with occupational dummies and a gender dummy is going to report all of the discrimination under the occupational dummies. If you interpret the results thinking that "discrimination" as Scott D defines it is only in the gender coefficient, you would say there is discrimination in the case of Outcome A, but that there's no discrimination in the case of Outcome B.

It would be one thing if these were very, very different sorts of discrimination but these are two reasonable outcomes from the exact same act of discrimination.

This is why people like Claudia Goldin see occupational dummies as describing the components of the wage gap and not as some way of eliminating part of the gap that isn't really about gender.

"Equal pay for equal work" is a principle that I should hope everyone can agree on. It's great stuff. And I for one think the courts might have some role to play in ensuring the principle is abided by in our society. But it's a pretty vacuous phrase when it comes to economic science. It's not entirely clear what it means or how it can be operationalized. Outcome A is clearly not equal pay for equal work, but what about Outcome B? After all the woman is being paid "fairly" for the work she ended up doing. Is that equal pay for equal work? You could make the argument but it doesn't feel right and in any case it's clearly incommensurate with the data analysis we're doing. When two things are incommensurate it's typically a good idea to keep them separate. Let "equal pay for equal work" ring out as a rallying call for a basic point of fairness and don't act like you can either affirm it or refute it with economic science. As far as I can tell you can't.

Wednesday, February 25, 2015

Postmodernism, pragmatism, and motte and bailey - a quick note

Whenever I identify my philosophical leanings I always like to qualify that I'm by no means a professional philosopher - it's simply what resonates with me of what I've read which is of course limited. That having been said for a while now I've identified with American pragmatism and in particular (although not on all points) Richard Rorty, who I've spent the most time with of all the pragmatists. Pragmatism of course has a lot of similarities to postmodernism.

In reading up a little on the motte and bailey fallacy after Julien's comment on the wage gap post, it seems that it's used by Shackel to point out the problems with postmodernism. Now I don't know what Shackel thinks of pragmatism (that's probably worth checking out) but it strikes me that a lot of what I like about pragmatism is precisely that pragmatism is sort of postmodernism without the motte and bailey fallacy. Postmodernism has a defensible core having to do with some sort of anti-foundationalism and social construction, etc. (their motte), and that's fine and Shackel seems to indicate that's fine. But then they build that out into much bigger claims that are less defensible. At pragmatism's core of course is the same anti-foundationalism but they are much less willing to go the extra step. Rorty constantly insists that he's not a relativist, that he's fine with concepts like progress as meaningful concepts, etc. His practical claims about human life are typically not that out of the ordinary. He only insists that we don't pretend they have what he'll often refer to as the Platonic foundation that we like to pretend they have.

Keep the postmodernist motte, skip the bailey.

I do like this concept a lot. So much of our discourse is a constellation of related arguments rather than a single argument and this helps to treat and evaluate that constellation of arguments as a whole.

I'm happy to have reactions to this - it was my spur of the moment reaction but I could be wrong.

In reading up a little on the motte and bailey fallacy after Julien's comment on the wage gap post, it seems that it's used by Shackel to point out the problems with postmodernism. Now I don't know what Shackel thinks of pragmatism (that's probably worth checking out) but it strikes me that a lot of what I like about pragmatism is precisely that pragmatism is sort of postmodernism without the motte and bailey fallacy. Postmodernism has a defensible core having to do with some sort of anti-foundationalism and social construction, etc. (their motte), and that's fine and Shackel seems to indicate that's fine. But then they build that out into much bigger claims that are less defensible. At pragmatism's core of course is the same anti-foundationalism but they are much less willing to go the extra step. Rorty constantly insists that he's not a relativist, that he's fine with concepts like progress as meaningful concepts, etc. His practical claims about human life are typically not that out of the ordinary. He only insists that we don't pretend they have what he'll often refer to as the Platonic foundation that we like to pretend they have.

Keep the postmodernist motte, skip the bailey.

I do like this concept a lot. So much of our discourse is a constellation of related arguments rather than a single argument and this helps to treat and evaluate that constellation of arguments as a whole.

I'm happy to have reactions to this - it was my spur of the moment reaction but I could be wrong.

Is my gender wage gap view a Motte and Bailey Doctrine?

Commenter Julien Couvreur taught me a fantastic new term today: the motte and bailey fallacy. I don't think his comment is persuasive at all, but it's interesting enough to spend some time talking about. A motte and bailey fallacy (for those of you who, like me, weren't aware of it) is according to Nicholas Shackel less a fallacy and more of a doctrine - or if you'd like a style of presenting an argument. You can read the Shackel link for background but the gist is that you promote and live in and enjoy in a less defensible but more desirable argumentative terrain when you can (the bailey), but when things get tough you retreat to the more defensible but less desirable terrain (the motte) and you treat them like the same thing. Julien alleges this is what I'm doing. Absolutely unequivocally I am not, but let's start with his comment:

"I smell a mote-and-bailey fallacy. Activists stretch and go wild with their interpretations, and when called on it, they fall back to the uncontroversial facts ("that's what we meant all along, you denier!"). The aggregate gender pay gap is real, and I doubt Bob questions it. But it is usually stated as women getting payed less "for the same job" or "for the same skills", explicitly or implicitly as the result of employer discrimination. That is simply incorrect and deserves to be called false, fallacious, a myth. Plus it offers no legs to the associated policy recommendation (forcing employers to pay "fairly")."

The problem here is I am not an activist. I am not Obama. I am not Arquette. My bailey is what I posted, and as far as I know I don't have a motte. Now Obama or Arquette might be guilty of the motte and bailey fallacy if they were pressed but I am absolutely not. I've never made anything like the switch that Julien describes.

A possible candidate for this (although I don't want to be too accusatory because I can't read his mind or his intentions) is Steve Horwitz's video on the wage gap. He leads with calling the wage gap a fallacy and only in the last minute or so of the video does he get into some of the qualifications that should lead to the conclusion that it's not a fallacy at all. So if one wanted to accuse him of a motte and bailey fallacy the first four minutes or so are his bailey and the last minute is his motte. Because of the time ordering that is possibly appropriate. Certainly enough people have mistakenly thought the first four minutes were his position that he had to do damage control and write a post correcting them. I don't want to push that too hard because keeping the qualifications towards the end doesn't in and of itself guarantee a motte and bailey fallacy (although it might not be the most strategic approach if you think that last minute is important to your point).

I also want to reemphasize an analytic point that I think Julien might have missed. He writes "The aggregate gender pay gap is real, and I doubt Bob questions it." I want to be clear that I am not concerned that anyone thinks the aggregate pay gap isn't real. I'm assuming everyone thinks it's real. I'm concerned that people are badly misinterpreting the meaning of the coefficients on the occupational dummies.

"I smell a mote-and-bailey fallacy. Activists stretch and go wild with their interpretations, and when called on it, they fall back to the uncontroversial facts ("that's what we meant all along, you denier!"). The aggregate gender pay gap is real, and I doubt Bob questions it. But it is usually stated as women getting payed less "for the same job" or "for the same skills", explicitly or implicitly as the result of employer discrimination. That is simply incorrect and deserves to be called false, fallacious, a myth. Plus it offers no legs to the associated policy recommendation (forcing employers to pay "fairly")."

The problem here is I am not an activist. I am not Obama. I am not Arquette. My bailey is what I posted, and as far as I know I don't have a motte. Now Obama or Arquette might be guilty of the motte and bailey fallacy if they were pressed but I am absolutely not. I've never made anything like the switch that Julien describes.

A possible candidate for this (although I don't want to be too accusatory because I can't read his mind or his intentions) is Steve Horwitz's video on the wage gap. He leads with calling the wage gap a fallacy and only in the last minute or so of the video does he get into some of the qualifications that should lead to the conclusion that it's not a fallacy at all. So if one wanted to accuse him of a motte and bailey fallacy the first four minutes or so are his bailey and the last minute is his motte. Because of the time ordering that is possibly appropriate. Certainly enough people have mistakenly thought the first four minutes were his position that he had to do damage control and write a post correcting them. I don't want to push that too hard because keeping the qualifications towards the end doesn't in and of itself guarantee a motte and bailey fallacy (although it might not be the most strategic approach if you think that last minute is important to your point).

I also want to reemphasize an analytic point that I think Julien might have missed. He writes "The aggregate gender pay gap is real, and I doubt Bob questions it." I want to be clear that I am not concerned that anyone thinks the aggregate pay gap isn't real. I'm assuming everyone thinks it's real. I'm concerned that people are badly misinterpreting the meaning of the coefficients on the occupational dummies.

Tuesday, February 24, 2015

Thinking clearly about the gender wage gap

Patricia Arquette recently promoted gender equality particularly as it relates to the wage gap at the Oscars. Some Facebook discussion followed, and Bob Murphy encouraged me to put my position in a blog post, so here it is.

My frustration with the empirics of the wage gap come in whenever - following something like the Arquette statement, or a mention of "77 cents on the dollar" in the State of the Union - people get up and assert that the wage gap is a "myth" or a "fallacy" simply because there are explanations for different contributions to the gap (some of these explanations are better than others). I think that's very misleading and that it's a mistake to use conditional mean differences in a regression to argue that the gap is mythical. I have always liked Claudia Goldin's approach (I linked to her first thing when I saw the Arquette news). Goldin says of the 77 cents on the dollar figure that "it's an accurate statement of what it is". The gap isn't a myth - it's real. The question is, what is the gap?

Some people are tempted to perform the following exercise:

1. Add a bunch of controls in a wage regression.

2. Note that the difference in conditional means between men and women shrinks when you do that.

3. Call the gap a "myth" or a "fallacy".

This is wrong for a number of reasons, and how it's wrong largely depends on how it's executed, interpreted, and qualified by the author. In other words doing steps 1 and 2 is totally fine. The problem comes in with step 3.

All adding occupational and educational controls does is parse out the within-occupation/education and between-occupation/education variation in the gap. Specifically, you are removing the between-occupation/education variation and leaving behind the within-occupation/education variation. Economists think wages and employment - prices and quantities - are jointly determined by supply and demand. Labor market disparities facing women are going to express themselves partly in the wage determination in a given occupation, and partly through the distribution of women across occupations. The analogy I made yesterday is that it would be nonsensical to say that blacks didn't face labor market discrimination in the postbellum South because black sharecroppers were approximately as a dirt poor as white sharecroppers (hypothetically - I'm not sure what the disparity was in sharecropping). That ignores the fact that differential treatment of blacks by employers lowered within-occupation wages and drove them to lower wage occupations. You can't separate the two points and you certainly can't dismiss the disparity because it shows up between occupations rather than within occupations.

The picture of between- and within-variation gets even more complicated when you consider the point that women are not passive actors in the labor market. They sort across occupations in response to anticipated earnings and other benefits. Women will sort into occupations where they have the greatest comparative advantage and likewise for men. If within-occupation variation (which drives this sorting behavior) is random this sorting won't matter much, but if within-occupation variation is correlated with between-occupation variation then it can matter a lot. This sort of effect was pointed out a long time ago by Roy (1951), and it's going to lead to bias in the coefficients on occupation (or perhaps it's better to say it's going to impact how you interpret the coefficients on occupation). Claudia Goldin has done a lot of work on where the within-occupation wage gaps are, but I'm not sure that she has looked into how this has impacted sorting behavior.

The take-away from all this is that it's misleading to say the wage gap is a myth by pointing at occupational controls. It is much sounder to follow Goldin's lead in her AEA presidential address and treat them as clues for understanding the various factors driving a very non-mythical wage gap.

Now if you want to go a step further and assert that you, individually, don't care about certain parts of the wage gap that's one thing. This gets very heated when we think about employment practices around pregnancy, for example. You're welcome to do that. But don't mislead about what the data say.

The good news is things are getting better. The wage gap has shrunk, female labor force participation and human capital investment is up. The last big thing to tackle is how the labor market handles pregnancy and children.

My frustration with the empirics of the wage gap come in whenever - following something like the Arquette statement, or a mention of "77 cents on the dollar" in the State of the Union - people get up and assert that the wage gap is a "myth" or a "fallacy" simply because there are explanations for different contributions to the gap (some of these explanations are better than others). I think that's very misleading and that it's a mistake to use conditional mean differences in a regression to argue that the gap is mythical. I have always liked Claudia Goldin's approach (I linked to her first thing when I saw the Arquette news). Goldin says of the 77 cents on the dollar figure that "it's an accurate statement of what it is". The gap isn't a myth - it's real. The question is, what is the gap?

Some people are tempted to perform the following exercise:

1. Add a bunch of controls in a wage regression.

2. Note that the difference in conditional means between men and women shrinks when you do that.

3. Call the gap a "myth" or a "fallacy".

This is wrong for a number of reasons, and how it's wrong largely depends on how it's executed, interpreted, and qualified by the author. In other words doing steps 1 and 2 is totally fine. The problem comes in with step 3.

All adding occupational and educational controls does is parse out the within-occupation/education and between-occupation/education variation in the gap. Specifically, you are removing the between-occupation/education variation and leaving behind the within-occupation/education variation. Economists think wages and employment - prices and quantities - are jointly determined by supply and demand. Labor market disparities facing women are going to express themselves partly in the wage determination in a given occupation, and partly through the distribution of women across occupations. The analogy I made yesterday is that it would be nonsensical to say that blacks didn't face labor market discrimination in the postbellum South because black sharecroppers were approximately as a dirt poor as white sharecroppers (hypothetically - I'm not sure what the disparity was in sharecropping). That ignores the fact that differential treatment of blacks by employers lowered within-occupation wages and drove them to lower wage occupations. You can't separate the two points and you certainly can't dismiss the disparity because it shows up between occupations rather than within occupations.

The picture of between- and within-variation gets even more complicated when you consider the point that women are not passive actors in the labor market. They sort across occupations in response to anticipated earnings and other benefits. Women will sort into occupations where they have the greatest comparative advantage and likewise for men. If within-occupation variation (which drives this sorting behavior) is random this sorting won't matter much, but if within-occupation variation is correlated with between-occupation variation then it can matter a lot. This sort of effect was pointed out a long time ago by Roy (1951), and it's going to lead to bias in the coefficients on occupation (or perhaps it's better to say it's going to impact how you interpret the coefficients on occupation). Claudia Goldin has done a lot of work on where the within-occupation wage gaps are, but I'm not sure that she has looked into how this has impacted sorting behavior.

The take-away from all this is that it's misleading to say the wage gap is a myth by pointing at occupational controls. It is much sounder to follow Goldin's lead in her AEA presidential address and treat them as clues for understanding the various factors driving a very non-mythical wage gap.

Now if you want to go a step further and assert that you, individually, don't care about certain parts of the wage gap that's one thing. This gets very heated when we think about employment practices around pregnancy, for example. You're welcome to do that. But don't mislead about what the data say.

The good news is things are getting better. The wage gap has shrunk, female labor force participation and human capital investment is up. The last big thing to tackle is how the labor market handles pregnancy and children.

Tuesday, February 3, 2015

Peter Lewin on Thomas Piketty

I've pointed out several times now that there are a few basic points that seem to commonly trip people up on Piketty. A confusing new critique of Piketty by Peter Lewin illustrates the trouble people often get into with at least a few of these points (HT Bob Murphy). I'd summarize the basic points I have in mind as:

I'll focus mainly on Lewin's "simple framework" in the first half of the post, although I have a few thoughts on the rest of the post as well. The framework is a straightforward national income equation, Y = rK + wL. Lewin then decomposes the growth rates of each component of national income to talk about Piketty's thinking on r > g and capital's share of income. This is all fine, until he brings Piketty into the picture. Lewin writes that "Piketty’s project is to show that the laws of capitalism imply that sK/sL rises without limit, thus destabilizing the society." In Lewin's post, sK/sL is capital's share of national income divided by labor's share of national income. This is where the problems start, of course. With a little bit of algebra we can see that Lewin is getting confused about my point #2 above. It is not Piketty's project to show that capital's share of income increases without limit. Piketty has two "fundamental laws" (a bit of an aggrandizement but the equations themselves are fine):

α = r*β, and

β = s/g

For Piketty, α is the same as Lewin's sK - it is capital's share of income. s is the savings rate and β is the capital stock divided by income. Therefore, 1- α is going to be equivalent to Lewin's sL. So Lewin is interested in α/(1-α). Substituting Piketty's second law into his first it's clear that α = rs/g, so α/(1-α) = rs/(g-rs). Piketty never puts it in these terms, of course. He's just concerned with α. But this is still the equilibrium value of the quantity Lewin thinks Piketty is concerned with. Does this "rise without limit"? No, of course not. And Piketty never says it does. In fact there's quite a bit of discussion in the book about the stability of α (and therefore the stability of α/(1-α)). Indeed the stability of α is at the very top of the list of Kaldor's facts, and the subject of quite a bit of recent discussion as labor's share has slipped a little.

Piketty spends a lot of time discussing all these issues and the steady growth of the capital share in the late 20th century (see Chapters 5 and 6), but he never claims that capital is growing without limit because r > g, which doesn't imply anything in particular about the capital share. He says there's been some increase because r has a tendency to grow somewhat with β (see pgs. 220-221), so as β climbs to its equilibrium level you're going to see some increase in r and some increase in the capital share, but only to rs/g, not an "increase without limit" as Lewin has it.

So Lewin seems to run up against my points #1 and #2 in some fashion at least. He goes on to confuse #3 as well. He writes "Piketty reasons that if the earnings of K grow more rapidly than earnings in general, this must imply that K’s share is growing, thus increasing inequality." This is where Lewin decomposes the growth rates. The problem is, the capital share is not the same thing as inequality. The capital share has to do with payments to factors of production, while inequality is a statement about the distribution of those payments across the population.

One of the strangest things about Lewin equating the two is that two of the biggest narratives that come out of Piketty's discussion of inequality directly contradict the conflation of the capital share with inequality. These are: (1.) the rise in the capital holdings of the middle class due to homeownership, and (2.) the critical role that labor income plays in the share of income held by the top 10% and the top 1%. Capital income doesn't dominate labor income until the very top of the income distribution. Piketty calls these earners of labor income the "super-managers". The capital share discussion is in Part II of the book, which deals with capital. The inequality discussion is in Part III of the book, which deals with inequality. They are not the same thing and the fundamental laws of capitalism certainly don't imply anything about inequality, at least not without a great deal of ambiguity.

The rest of the post

The rest of Lewin's post is a mixed bag. I agree with him on some of the points, and I think he agrees with Piketty more than he realizes on some of the others. After his "simple framework" Lewin explains that factor income is not the same as income inequality. Indeed, and Piketty thinks so as well which I point out above. He then criticizes Piketty for excluding human capital. I've had this concern in the past as well (as has David Weil at the AEA meeting). Lewin calls the exclusion "cavalier" which I think is extremely unfair. It makes perfect sense why Piketty would exclude human capital from this discussion. It can't be sold on capital markets, and it can't be inherited so it's not directly relevant to his discussion of physical and financial capital. I get that, but I do think it's an important part of the income distribution story which is why I'd love to hear more about it (plus I'm a labor economist so of course I'm interested).

I find the next few sections of Lewin odd. My impression is that Piketty agrees with Lewin on the rest of the post. From the very beginning of the discussion of the fundamental laws, Piketty talks about how capital is heterogeneous and how different types of capital have different rates of return (pg. 52). Lewin is also wrong when he says "It [K] is meant to be an index of the physical magnitude of the capital of the economy". No, it's not! It's the value of the capital, not a physical quantity!

Finally Lewin criticizes Piketty for allegedly equating the rate of return with the interest rate. He doesn't do this either, of course. On page 52 he writes "the rate of return on capital measures the yield on capital over the course of a year regardless of its legal form (profits, rent, dividends, interest, royalties, capital gains, etc.), expressed as a percentage of the value of capital invested. It is therefore a broader notion than the "rate of profit," and much broader than the "rate of interest," while incorporating both."

So tread carefully when reading Lewin, I think. But it is a nice illustration of some common confusions about Piketty.

1. r > g did not surprise any economist. It's not a radical result at all, and it's very familiar and well understood.

2. r > g does not imply that the capital stock as a share of income will go off to infinity. In fact as long as r and g (and s) remain fairly stable it implies an equilibrium capital stock level (Piketty guesses it will level off at around 700% of income).

3. The capital share of income is not the same thing as "inequality". The capital share informs us about the source of income. Inequality is about it's distribution across the population. On inequality Piketty prefers to use the 10% share and the 1% share of income.

Lewin's simple framework

4. Inequality for Piketty is not directly governed by r > g, it's primarily determined by institutional factors. Piketty does think r > g makes inheritance a more important factor, but the ultimate impact of inheritance on inequality is mediated by institutions.

I'll focus mainly on Lewin's "simple framework" in the first half of the post, although I have a few thoughts on the rest of the post as well. The framework is a straightforward national income equation, Y = rK + wL. Lewin then decomposes the growth rates of each component of national income to talk about Piketty's thinking on r > g and capital's share of income. This is all fine, until he brings Piketty into the picture. Lewin writes that "Piketty’s project is to show that the laws of capitalism imply that sK/sL rises without limit, thus destabilizing the society." In Lewin's post, sK/sL is capital's share of national income divided by labor's share of national income. This is where the problems start, of course. With a little bit of algebra we can see that Lewin is getting confused about my point #2 above. It is not Piketty's project to show that capital's share of income increases without limit. Piketty has two "fundamental laws" (a bit of an aggrandizement but the equations themselves are fine):

α = r*β, and

β = s/g

For Piketty, α is the same as Lewin's sK - it is capital's share of income. s is the savings rate and β is the capital stock divided by income. Therefore, 1- α is going to be equivalent to Lewin's sL. So Lewin is interested in α/(1-α). Substituting Piketty's second law into his first it's clear that α = rs/g, so α/(1-α) = rs/(g-rs). Piketty never puts it in these terms, of course. He's just concerned with α. But this is still the equilibrium value of the quantity Lewin thinks Piketty is concerned with. Does this "rise without limit"? No, of course not. And Piketty never says it does. In fact there's quite a bit of discussion in the book about the stability of α (and therefore the stability of α/(1-α)). Indeed the stability of α is at the very top of the list of Kaldor's facts, and the subject of quite a bit of recent discussion as labor's share has slipped a little.