Bob responds to Brad DeLong and suggests Krugman's buttressing his point.

Errrmmm... only if you had a really bizarre perspective on this in the first place.

Perhaps Bob should take Krugman’s post as evidence that nobody disagreed with him on the relationship between investment and potential output (that this is not just something that Austrians and Larry Summers have come up with).

Perhaps?

I feel like I have a decent grasp of the way Bob thinks, and I'm honestly baffled how he could write that in the first place. And maybe he doesn't think that, it's just a little rhetorical flare (that would make me feel a lot better). But if he does, maybe that's the place to start.

That would imply that the disagreement is elsewhere – over the degree of the effect and the strength of DeLong’s initial point. Bob seems to think that DeLong is using a particular meaning of “materially lower” and he is hanging an awful lot on the assumption that Brad is using that phrase in that way.

Thursday, August 29, 2013

Wednesday, August 28, 2013

Old post on the economics of Dr. King

One of those things I really want to revisit in more detail and have maybe 2,500 words down on, but just haven't.

- The economic thought of Dr. King

- Dr. King on property

- Dr. King on calculation

- Recent excellent blog post from the Urban Institute on the March on Washington

- A Dr. King/Obama connection on individual vs. social production

Also - here's a new post from the Urban Institute

- The economic thought of Dr. King

- Dr. King on property

- Dr. King on calculation

- Recent excellent blog post from the Urban Institute on the March on Washington

- A Dr. King/Obama connection on individual vs. social production

Also - here's a new post from the Urban Institute

It's an American economic thought/economic history Amazon day

- The Road to Plenty

Foster, William Trufant and Waddill Catchings

- The Distribution of Wealth: a Theory of Wages, Interest and Profits

John Bates Clark

- A Guide to Keynes

Alvin Hansen

- Sharing the Prize: The Economics of the Civil Rights Revolution in the American South

Wright, Gavin

- Wages and Labor Markets in the United States, 1820-1860 (National Bureau of Economic Research Series on Long-Term Factors in Economic Development)

Margo, Robert A.

Foster, William Trufant and Waddill Catchings

- The Distribution of Wealth: a Theory of Wages, Interest and Profits

John Bates Clark

- A Guide to Keynes

Alvin Hansen

- Sharing the Prize: The Economics of the Civil Rights Revolution in the American South

Wright, Gavin

- Wages and Labor Markets in the United States, 1820-1860 (National Bureau of Economic Research Series on Long-Term Factors in Economic Development)

Margo, Robert A.

Monday, August 26, 2013

Would you like some aloe vera? Bob Murphy, Brad DeLong, and Paul Krugman

As probably the only person on the whole wide internets that likes Bob, Brad, and Paul, I feel obligated to relink.

1. Brad DeLong

2. Bob Murphy

3. Brad DeLong (ouch!)

4. Paul Krugman (OUCH!)

I obviously agree with Brad and Paul a zillion times more often than I agree with Bob, but let's put that aside for a second. I didn't get involved in the initial post by Bob because I've been busy and it looked like an in-the-data-weeds sort of post. But also because I doubted it would amount to much. Paul Krugman tells us that the CBO is not stupid. This is true. They have some really smart people there and dumb mistakes simply aren't their thing. But it is even more true that Brad DeLong is one of the most careful bloggers out there. IMO he passes Krugman in this regard. Krugman has a tendency to make sweeping statements, get grouchy about the state of economics, etc. which leads him to make broad claims sometimes that don't hold up. Brad is more careful than Krugman in that sense.

Another way of putting this is that Brad is a great details guy in his posts and Paul is a great big picture guy in his posts. I feel like I disagree with Brad sometimes too - but I feel like I take my life into my hands when I do.

That having been said, I will still push the hopeless line that Keynesians ought to follow Bob's blog. Unfortunately, a lot of Austrian bloggers don't offer much interesting. It's complaining about vaguish methodological concerns. Bob, meanwhile, doesn't raise some kind of purist methodological objections - he jumps into mainstream modeling and keeps up with the best of them (Nick Rowe, for example). Bob also doesn't really have any sacred cows. He's happy to knock Mises and Hayek on substantial points and not only agree with Sraffa but claim that Sraffa didn't go far enough. And he's a clear writer. He's too obsessed with Krugman gotchas IMO, but nobody's perfect. I'm sure there are things about me that bug people too. So I enjoy following him.

Saturday, August 24, 2013

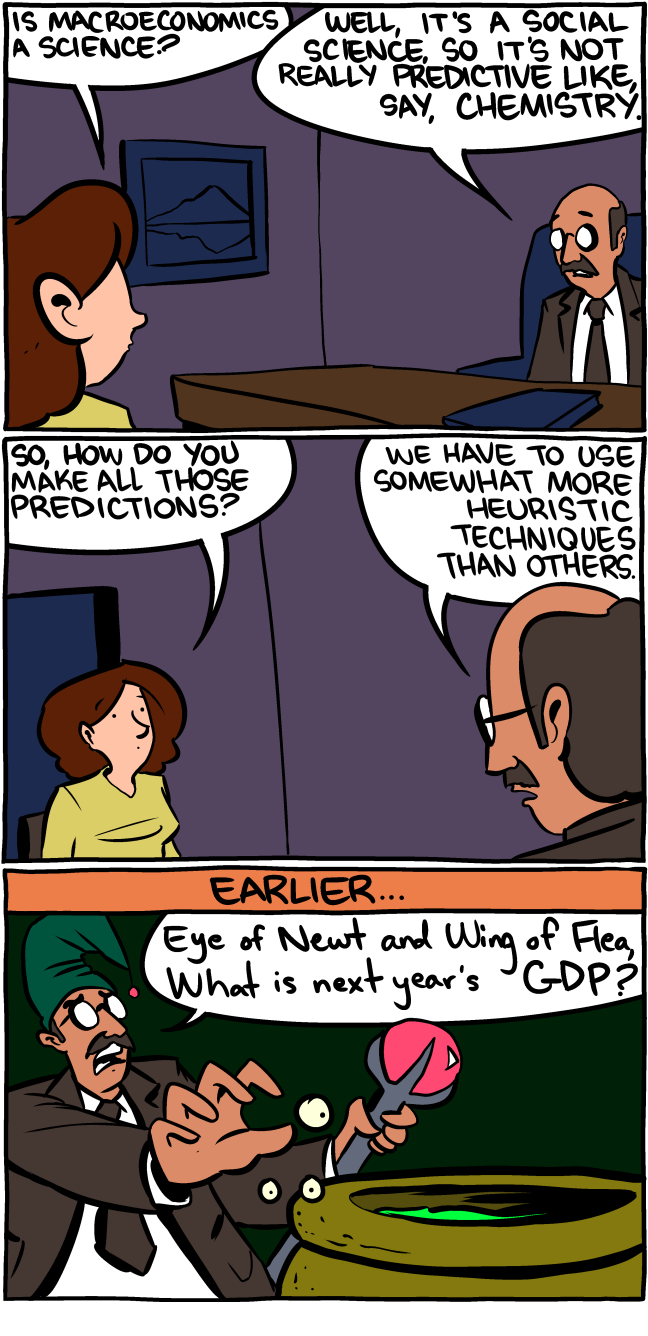

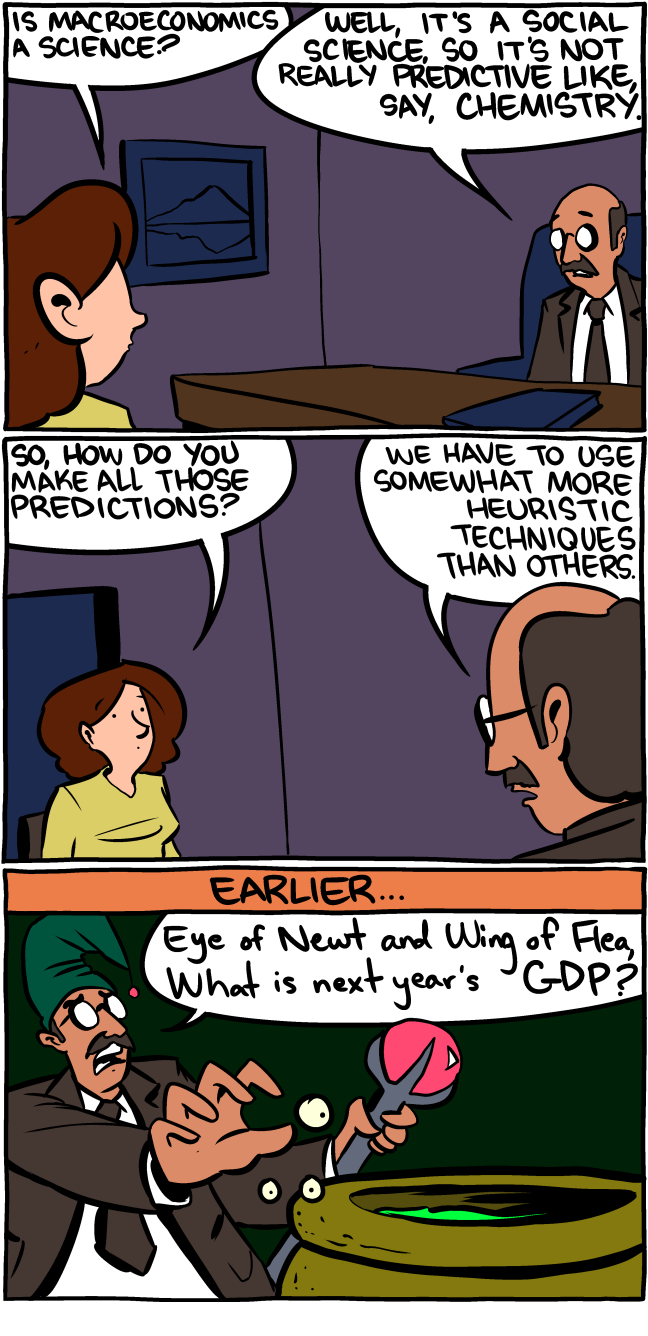

Two interesting observations on this economath discussion

Noath Smith, Paul Krugman, Bryan Caplan, David Henderson (and me, but I'm a bit player) have been talking about math in economics lately. I'll let you look up all the posts.

I've noticed two funny things.

I've noticed two funny things.

1. The people who are generally opposed seem to treat the argument as economic intuition/relevance vs. mathematical economics. This is a category error. Economic intuition/relevance is something we expect to be in all good economics, whether it is literary or mathematical. And there's definitely examples of both with and without good relevance and good foundational economic principles. That's the substance of a piece of economics. The math/literary question is the medium. The real question is the comparative strength of the medium.My view is that both are important and we should expect people going through the PhD process to be able to write and do math well and be excellent consumers of both. I am not worried that good people are kept out because of math standards. There is a substantial enough demand for PhD slots that there's no reason why programs can't be choosy and get people good at both. So I don't think we should lower our math expectations - if anything we should raise our literary expectations. This is coming from a guy whose writing is certainly stronger than his math and for whom that certainly made a difference in his PhD application experience, so I'm not giving math expectations a pass because I'm some kind of hot shot.

2. If find it interesting that there is a fight about math's role in economics but there seems to be little fight at all about the role of literary economics. In other words you've got people talking as if the highly mathematical papers have somehow gone off the rails but you don't have anyone criticizing the major literary contributions. I find that interesting.

Friday, August 23, 2013

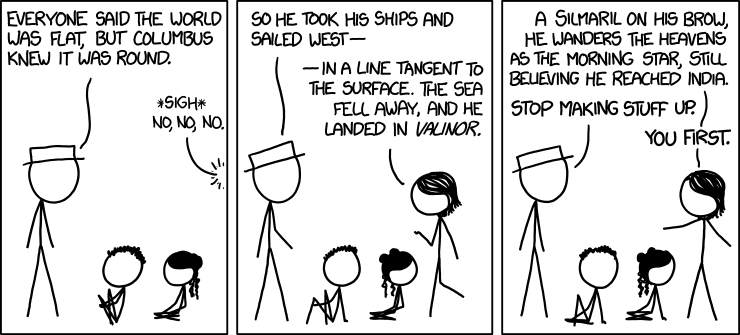

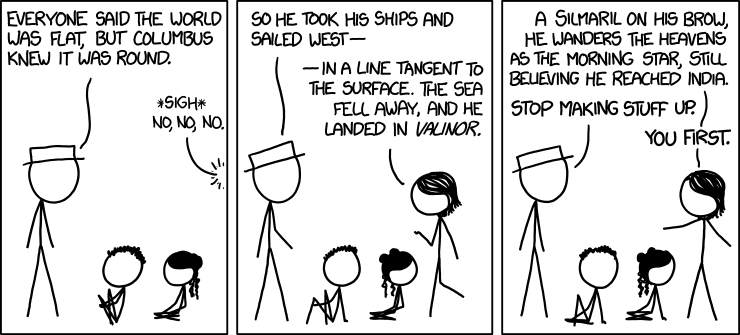

I think Randall Munroe reads Gene Callahan

Probably not, but hey - that logic worked for Farmer on Krugman (I actually like Farmer, but that letter was just bizarre).

http://xkcd.com/1255/

http://xkcd.com/1255/

Wednesday, August 21, 2013

Galbraith question

I've seen this all over the place: “the conventional view serves to protect us from

the painful job of thinking”. I was going to use it but can't find a citation to it. Does anyone know where he actually said this? Maybe it was spoken rather than written which is why sourcing it is so hard? Lots of people quote him on it but I can't find any citations yet.

Jonathan Catalan makes an odd claim

He writes: "Say there is country A who conquers countries B, C, & D, imposing external costs on country Z, and even threatening large future costs (e.g. an invasion). It may make sense for country Z to increase war spending to organize a way of reducing total future costs by preemptively eliminating A’s capacity to impose costs on Z. That doesn’t necessarily mean that Z’s war spending creates a net benefit, it just mitigates the loss."

I guess health care spending doesn't involve a net benefit either! That is just mitigating a loss - my eventual breakage and death.

Of course what's really at issue here is how we're netting things out. I can't control what A does. So I take it as given. When I assess net benefits it's going to be based on the consequences of my decision.

I guess health care spending doesn't involve a net benefit either! That is just mitigating a loss - my eventual breakage and death.

Of course what's really at issue here is how we're netting things out. I can't control what A does. So I take it as given. When I assess net benefits it's going to be based on the consequences of my decision.

Noah Smith on math, and some of my thoughts (coming at this from a different angle)

Noah Smith has an excellent post on his journey from high school, to physics, to economics, and the role that math played. To summarize he started out talented at but bored with math in high school, became very captivated by it and its predictive power studying physics, and then ran into some disappointment with the way math was used in economics (particularly macro). A good summary of his concern is provided here:

I come at this from a different perspective and would add one more way to use math to the list that I think characterizes most math in economics.

In high school, I was "good, not great" at math. I was in the advanced classes, but not the most advanced classes (probably due to where I was tracked early on more than anything else). I had no real interest in doing much of it in college. I knew I wanted to study economics (and very quickly realized I had to do some more math), and had initially planned on double-majoring in government. But in my freshman year, practically randomly, I took a criminology class in the sociology department and was hooked on sociology. I never took any more government after that and I double majored in economics and sociology.

Sociology is very different from economics. There are some great empirical sociologists but sociological theory isn't nearly as formalized as economic theory (there are some important exceptions, for example people dealing with social networks). There are some good reasons for this - what sociologists deal with is harder to quantify and therefore harder to formalize. But that comes with costs. When you take a theoretical outlook in sociology you are juggling lots of different forces and trying to make sense of how they work together and feed back into each other. That's very hard, and the quality of the theory is obviously going to suffer because it's hard. That's not a slight on sociologists - that's just the nature of the problem.

Economics is different. We're dealing with trade-offs - comparisons - which are therefore eligible for mathematical representation. We're also often dealing with quantifiable things. That means math has a real shot in economics.

But Noah is right that it's not quite the same as physics. Our microfoundations and really any equation - microfoundation or not - is not as concrete or testable as it is in physics.

For me, that misses the point of the value of math in economics. Of course it would be nice if we could get more concrete in the way that Noah is suggesting physics is concrete. There are some obvious advantages associated with that. But the big advantage of math in economics is that all those complex interactions and variables that sociological theory is juggling can be much more carefully laid out and related to each other. That is not a guarantee that we are hitting on laws of the universe the way physics is (although good Kuhnians have to take that bit of language about "laws" with a grain of salt anyway). It is, however, a path to a much more coherent and useful way of doing social theory than probably any other social science offers.

This, I think, is very clear if you're coming to economics from another social science. It is less clear if you come from the natural sciences and try to cut and paste your experiences from the natural sciences.

So for me, it's primarily not about signaling or obscurantism. It's about making our ideas clear. That helps to test and arbitrate between different ideas. We're not getting at any kind of precise laws yet. I'm guessing we never will. It's just not the nature of the beast. We are learning a lot about how the world works, though.

"In macro, most of the equations that went into the model seemed to just be assumed. In physics, each equation could be - and presumably had been - tested and verified as holding more-or-less true in the real world. In macro, no one knew if real-world budget constraints really were the things we wrote down. Or the production function. No one knew if this "utility" we assumed people maximized corresponded to what people really maximize in real life. We just assumed a bunch of equations and wrote them down. Then we threw them all together, got some kind of answer or result, and compared the result to some subset of real-world stuff that we had decided we were going to "explain". Often, that comparison was desultory or token, as in the case of "moment matching"."So he begins by discussing one way that math is used by scientists - to represent reality precisely and predict its behavior. He discusses two other uses of math that he thinks are common in economics: signaling that you're smart and obscurantism. I can't disagree that these things go on, although I think it's very hard to get away with it. Most celebrated economists really do have something valuable to say - a contribution - and could not win their acclaim just by doing hard math. Some of the most celebrated papers have fairly accessible math, after all.

I come at this from a different perspective and would add one more way to use math to the list that I think characterizes most math in economics.

In high school, I was "good, not great" at math. I was in the advanced classes, but not the most advanced classes (probably due to where I was tracked early on more than anything else). I had no real interest in doing much of it in college. I knew I wanted to study economics (and very quickly realized I had to do some more math), and had initially planned on double-majoring in government. But in my freshman year, practically randomly, I took a criminology class in the sociology department and was hooked on sociology. I never took any more government after that and I double majored in economics and sociology.

Sociology is very different from economics. There are some great empirical sociologists but sociological theory isn't nearly as formalized as economic theory (there are some important exceptions, for example people dealing with social networks). There are some good reasons for this - what sociologists deal with is harder to quantify and therefore harder to formalize. But that comes with costs. When you take a theoretical outlook in sociology you are juggling lots of different forces and trying to make sense of how they work together and feed back into each other. That's very hard, and the quality of the theory is obviously going to suffer because it's hard. That's not a slight on sociologists - that's just the nature of the problem.

Economics is different. We're dealing with trade-offs - comparisons - which are therefore eligible for mathematical representation. We're also often dealing with quantifiable things. That means math has a real shot in economics.

But Noah is right that it's not quite the same as physics. Our microfoundations and really any equation - microfoundation or not - is not as concrete or testable as it is in physics.

For me, that misses the point of the value of math in economics. Of course it would be nice if we could get more concrete in the way that Noah is suggesting physics is concrete. There are some obvious advantages associated with that. But the big advantage of math in economics is that all those complex interactions and variables that sociological theory is juggling can be much more carefully laid out and related to each other. That is not a guarantee that we are hitting on laws of the universe the way physics is (although good Kuhnians have to take that bit of language about "laws" with a grain of salt anyway). It is, however, a path to a much more coherent and useful way of doing social theory than probably any other social science offers.

This, I think, is very clear if you're coming to economics from another social science. It is less clear if you come from the natural sciences and try to cut and paste your experiences from the natural sciences.

So for me, it's primarily not about signaling or obscurantism. It's about making our ideas clear. That helps to test and arbitrate between different ideas. We're not getting at any kind of precise laws yet. I'm guessing we never will. It's just not the nature of the beast. We are learning a lot about how the world works, though.

Assault of thoughts - 8/21/2013

"Words ought to be a little wild, for they are the assault of thoughts on the unthinking" - JMK

- Bob Murphy finds an awkward footnote. The EPA is really up a creek on this one. As Bob lays out, it's hard to know what else they could have done short of redoing the administration Working Group's work for them. And this comes up in empirical work. Sometimes things just can't be nicely squared off and you're up-front about it and try to finesse it and move on as quickly as you can. Still - very awkward and very funny.

- I am reading David Card's 2011 article "Origins of the Unemployment Rate" for a chapter I'm writing and I'm really enjoying it. If you're like me and you enjoy (1.) labor economics, (2.) empirical puzzles, (3.) American economic history, and (4.) history of economic thought then I think you'll enjoy it too - it's got all of that.

- LK addresses the problem with Steve Horwitz's take on WWII and the immediate post-war period here and here. He makes a point that I very much sympathize with and have made here before: if you try to spin fighting the advance of fascism across the globe as wasteful spending then you need to stop, take a deep breath, and think a little harder about what you are claiming.

- Grant McDermott discusses the empirical ABCT paper I linked to recently on here, and provides some thoughts on the reaction of one of his Austrian sparring partners.

- If you are interested in the economics of Africa, a classmate of mine has recently started blogging on Zambia.

- Bob Murphy finds an awkward footnote. The EPA is really up a creek on this one. As Bob lays out, it's hard to know what else they could have done short of redoing the administration Working Group's work for them. And this comes up in empirical work. Sometimes things just can't be nicely squared off and you're up-front about it and try to finesse it and move on as quickly as you can. Still - very awkward and very funny.

- I am reading David Card's 2011 article "Origins of the Unemployment Rate" for a chapter I'm writing and I'm really enjoying it. If you're like me and you enjoy (1.) labor economics, (2.) empirical puzzles, (3.) American economic history, and (4.) history of economic thought then I think you'll enjoy it too - it's got all of that.

- LK addresses the problem with Steve Horwitz's take on WWII and the immediate post-war period here and here. He makes a point that I very much sympathize with and have made here before: if you try to spin fighting the advance of fascism across the globe as wasteful spending then you need to stop, take a deep breath, and think a little harder about what you are claiming.

- Grant McDermott discusses the empirical ABCT paper I linked to recently on here, and provides some thoughts on the reaction of one of his Austrian sparring partners.

- If you are interested in the economics of Africa, a classmate of mine has recently started blogging on Zambia.

Tuesday, August 20, 2013

One more point on Galbraith

He was a Keynesian in some ways, but an Institutionalist at heart.

So when he makes these criticisms he's coming from a theoretical background that is in a lot of ways more similar to Hayek than to Keynes and the monetarists. He is looking at trends in corporate power and behavior as the explanation for these issues. And he is looking at the Keynesians as people who are talking about different stuff.

So my guess for how this came about is that he's not an insider chastising his fellow Keynesians for naiveté. He's an outsider in a dying theoretical tradition taking a potshot. And the RESTAT editors rightfully called B.S. (or he realized it was B.S. before it got too far along).

So when he makes these criticisms he's coming from a theoretical background that is in a lot of ways more similar to Hayek than to Keynes and the monetarists. He is looking at trends in corporate power and behavior as the explanation for these issues. And he is looking at the Keynesians as people who are talking about different stuff.

So my guess for how this came about is that he's not an insider chastising his fellow Keynesians for naiveté. He's an outsider in a dying theoretical tradition taking a potshot. And the RESTAT editors rightfully called B.S. (or he realized it was B.S. before it got too far along).

Two quick links back here

- First, from Brad DeLong - he reproduces an old post of mine on Sumner and how "haters gonna hate" (just love picturing Brad DeLong say that)

- Second, David Henderson finds my point on Keynes and uniform movement of industries convincing and links back graciously. So graciously, in fact, that I hate to pick a nit and make a plea for putting more meat on this, but I feel I must. He says that Galbraith probably shouldn't have roped Keynes in, but that it just should have been edited to include the Keynesians that are guilty of this. The thing is, I still have no idea why he thinks any Keynesians think this. It's really a silly idea in the first place and I think deleting the whole thing was the right move. I've confessed that I don't know Robinson or Harrod (and now he adds Hansen and Hicks) as well as Keynes, so the fact that David is still keeping them on the list makes me more interested in crowdsourcing this. Why in the world would you accuse them of this? Anybody know? I'm left proving a negative unless everyone on David's list has a clear alternative claim like Keynes does. But does anyone know of anything to justify David's bearishness on early Keynesians? I anticipate Bob Murphy would share this post of Krugman's, but that hardly makes the cut in my opinion. Clearly everyone that thinks the problem is at all related to aggregate demand or monetary disequilibrium will think both the crisis and the recovery will be broad based - but that's quite clearly not the view that Galbraith is criticizing (we can talk more about that if he or anyone else actually thinks there's a case there). Anything else? What do you think of David's edits vs. mine (and more importantly, why)? If any of the early Keynesians that David lists actually thought this I would have to steeply discount my opinion of them.

- Second, David Henderson finds my point on Keynes and uniform movement of industries convincing and links back graciously. So graciously, in fact, that I hate to pick a nit and make a plea for putting more meat on this, but I feel I must. He says that Galbraith probably shouldn't have roped Keynes in, but that it just should have been edited to include the Keynesians that are guilty of this. The thing is, I still have no idea why he thinks any Keynesians think this. It's really a silly idea in the first place and I think deleting the whole thing was the right move. I've confessed that I don't know Robinson or Harrod (and now he adds Hansen and Hicks) as well as Keynes, so the fact that David is still keeping them on the list makes me more interested in crowdsourcing this. Why in the world would you accuse them of this? Anybody know? I'm left proving a negative unless everyone on David's list has a clear alternative claim like Keynes does. But does anyone know of anything to justify David's bearishness on early Keynesians? I anticipate Bob Murphy would share this post of Krugman's, but that hardly makes the cut in my opinion. Clearly everyone that thinks the problem is at all related to aggregate demand or monetary disequilibrium will think both the crisis and the recovery will be broad based - but that's quite clearly not the view that Galbraith is criticizing (we can talk more about that if he or anyone else actually thinks there's a case there). Anything else? What do you think of David's edits vs. mine (and more importantly, why)? If any of the early Keynesians that David lists actually thought this I would have to steeply discount my opinion of them.

Thumbing through the General Theory again...

...for class. Keynes is at the end of the semester so I am leaving the exact nature of the lectures TBD right now, but I want to get a general idea of what I want to do so I've been rereading. I was reading the chapter on expectations last night (chapter 5, not the chapter 12 stuff Krugman refers to in his discussion of the two different ways of reading the General Theory). First and foremost, it's very good. But it also struck me that New Keynesianism, for all the crap it gets from the Post-Keynesian crowd, is really the rest of the economics profession catching up to the General Theory. None of the rational expectations revolution would have been problematic for Keynes, and a forward-looking IS curve with a monetary policymaker that manages expectations is precisely what he discusses from the very beginning.

When you model, of course, you don't bite it all off in one go. I think the Old Keynesian interlude was necessary in that sense. But the sorts of people who get nostalgic for good ol' IS-LM or for the Post-Keynesian stuff are, I think, missing out big. There's value in the Post-Keynesian material and there's pedagogical value in IS-LM, but no cause for turning the clock back before the 1970s. This isn't some kind of partisan's claim that we have to hew to Keynes. We drop him when there's good reason to. It's just to say that Keynes was a genius who offered a paradigm shift, that science progresses, but recognizing that there was clearly a lot genius left to be formalized that gave people things to do for several decades.

I think I'm going to really enjoy reading this cover-to-cover again. I've only selectively read it lately (although I've probably worked through the whole thing on a selective basis) - haven't read it all the way through since 2006.

When you model, of course, you don't bite it all off in one go. I think the Old Keynesian interlude was necessary in that sense. But the sorts of people who get nostalgic for good ol' IS-LM or for the Post-Keynesian stuff are, I think, missing out big. There's value in the Post-Keynesian material and there's pedagogical value in IS-LM, but no cause for turning the clock back before the 1970s. This isn't some kind of partisan's claim that we have to hew to Keynes. We drop him when there's good reason to. It's just to say that Keynes was a genius who offered a paradigm shift, that science progresses, but recognizing that there was clearly a lot genius left to be formalized that gave people things to do for several decades.

I think I'm going to really enjoy reading this cover-to-cover again. I've only selectively read it lately (although I've probably worked through the whole thing on a selective basis) - haven't read it all the way through since 2006.

Monday, August 19, 2013

It's probably good that that one was cut! Galbraith and Keynes

David Henderson shares a paragraph from a RESTAT article of Galbraith's that he likes, but which was cut from ultimate publication. It reads:

Recently commenter Blue Aurora asked me something about the General Theory that directed me back to Book V. In discussing Pigou there Keynes makes exactly the opposite claim - he's talking about the employment functions of different industries which he assumes are different. It's in the math, he's assuming different functions, but if you want to skip over the math he writes next (p. 286):

Now you might argue that maybe in his most important statement of economic theory Keynes thought nothing like what Galbraith claimed he thought, but perhaps he had some off-hand remarks. Maybe. I'm not well-versed in all his public pronouncements (and he was a very public figure). Nothing I've read resembles what Galbraith is claiming, but it's possible. So I'll outsource that - does anyone know of a time when Keynes (or Robinson or Harrod) suggested that all industries would approach full employment uniformly? Feel free to share in the comments.

Otherwise, I think we have to conclude that this paragraph probably wasn't dropped randomly - there was a good reason for doing it!

"I am inclined to believe that the development of the concept of full employment in recent years has given us a rather warped technical apparatus for dealing with this problem. Keynes, Mrs. Robinson, Harrod, and the rest have talked glibly about full employment as a flat ceiling which is approached uniformly by all sectors of the economy--they have assumed that the production functions for different industries are similarly shaped and, at any time, the rate of utilization is uniform. Nothing, of course, could be further from the truth."Very saucy, but I can't help but thinking that it was awfully good for Galbraith's reputation that it was cut (presumably by editors or referees, but maybe by Galbraith himself - I wonder if RESTAT keeps copies of referee reports). I guess I can't speak in detail for Robinson or Harrod (although I'd be shocked if they felt all that differently), but Keynes of course never thought anything like this and I can't recall an instance where he suggested that all sectors approach full employment uniformly.

Recently commenter Blue Aurora asked me something about the General Theory that directed me back to Book V. In discussing Pigou there Keynes makes exactly the opposite claim - he's talking about the employment functions of different industries which he assumes are different. It's in the math, he's assuming different functions, but if you want to skip over the math he writes next (p. 286):

"Let us return to the employment function. We have assumed in the foregoing that to every level of aggregate effective demand there corresponds a unique distribution of effective demand between the products of each individual industry. Now, as aggregate expenditure changes, the corresponding expenditure on the products of an individual industry will not, in general, change in the same proportion; — partly because individuals will not, as their incomes rise, increase the amount of the products of each separate industry, which they purchase, in the same proportion, and partly because the prices of different commodities will respond in different degrees to increases in expenditure upon them.Well that's awkward for Galbraith! And it's not just here Look in the chapter on Sundry Observations on the Nature of Capital (discussed here recently with respect to a Nick Rowe post), or the discussion of the marginal efficiency of capital. You can also look in the concluding chapter where he says that you cannot give government the job of making decisions about the direction of economic activity - only its volume - because it cannot be easily assessed without the price mechanism.

It follows from this that the assumption upon which we have worked hitherto, that changes in employment depend solely on changes in aggregate effective demand (in terms of wage-units), is no better than a first approximation, if we admit that there is more than one way in which an increase of income can be spent. For the way in which we suppose the increase in aggregate demand to be distributed between different commodities may considerably influence the volume of employment. If, for example, the increased demand is largely directed towards products which have a high elasticity of employment, the aggregate increase in employment will be greater than if it is largely directed towards products which have a low elasticity of employment.

In the same way employment may fall off without there having been any change in aggregate demand, if the direction of demand is change in favour of products having a relatively low elasticity of employment.

These considerations are particularly important if we are concerned with short-period phenomena in the sense of changes in the amount or direction of demand which are not foreseen some time ahead. Some products take time to produce, so that it is practically impossible to increase the supply of them quickly. Thus, if additional demand is directed to them without notice, they will show a low elasticity of employment; although it may be that, given sufficient notice, their elasticity of employment approaches unity."

Now you might argue that maybe in his most important statement of economic theory Keynes thought nothing like what Galbraith claimed he thought, but perhaps he had some off-hand remarks. Maybe. I'm not well-versed in all his public pronouncements (and he was a very public figure). Nothing I've read resembles what Galbraith is claiming, but it's possible. So I'll outsource that - does anyone know of a time when Keynes (or Robinson or Harrod) suggested that all industries would approach full employment uniformly? Feel free to share in the comments.

Otherwise, I think we have to conclude that this paragraph probably wasn't dropped randomly - there was a good reason for doing it!

Manski on taxes

Manski criticizes the emphasis on deadweight loss in discussions of taxation here (a summary of new research in The Economic Journal). Tyler Cowen has criticisms here. I mostly agree with Tyler. I do think people make too much of findings that X tax is inefficient relative to lump sum taxes (to say nothing of the frequent use of lump sum taxes in analyses). Since no one is ever going to advocate a lump sum tax, as an entrée to a normative discussion of taxes that sort of observation seems useless. But by the same token, benchmarks are just that - they don't necessarily have to be a goal anyone expects (the same can be said for "perfect competition" - too much ink is spilled over whining about that as a benchmark).

Manski proposes integrating discussions of the efficiency of government spending into these discussions of the efficiency of taxation. I also agree with Tyler here - it's perfectly valid to separate the two and everyone has in the back of their heads that we tax (often inefficiently) because of the added efficiency of wise government spending.

I don't know the public economics literature all that well, but if I were to raise a criticism it would be around the diminishing marginal utility of money for certain populations. Welfare is our ultimate interest here and presumably that makes up for a lot of the inefficiencies - particularly with respect to the income tax. Manski proposes specifying social welfare functions as an alternative, and in many ways my complaint here is similar to that. Of course that's difficult for many reasons. It's easier for economists to agree on supply and demand curves in different markets to calculate deadweight loss than it is for them to agree on a social welfare function. That may be the case, but it doesn't validate the decision to ignore that issue.

As you all know, I don't do tax or public economic stuff - I mention Manski because in a couple weeks I'll be attending a four part lecture that he's giving on his new book at Georgetown University. The book is called "Public Policy in an Uncertain World".

Manski proposes integrating discussions of the efficiency of government spending into these discussions of the efficiency of taxation. I also agree with Tyler here - it's perfectly valid to separate the two and everyone has in the back of their heads that we tax (often inefficiently) because of the added efficiency of wise government spending.

I don't know the public economics literature all that well, but if I were to raise a criticism it would be around the diminishing marginal utility of money for certain populations. Welfare is our ultimate interest here and presumably that makes up for a lot of the inefficiencies - particularly with respect to the income tax. Manski proposes specifying social welfare functions as an alternative, and in many ways my complaint here is similar to that. Of course that's difficult for many reasons. It's easier for economists to agree on supply and demand curves in different markets to calculate deadweight loss than it is for them to agree on a social welfare function. That may be the case, but it doesn't validate the decision to ignore that issue.

As you all know, I don't do tax or public economic stuff - I mention Manski because in a couple weeks I'll be attending a four part lecture that he's giving on his new book at Georgetown University. The book is called "Public Policy in an Uncertain World".

Sunday, August 18, 2013

Emily Oster on pregnancy

This is a good article by Emily Oster, an economist, on pregnancy in the WSJ. She takes a closer look at the research behind the dos and don'ts that overwhelm expecting mothers. I have a mix of reactions here.

First, this is another example (like Bob Murphy's discussion the other day of military suicides), where experimental scientists are often at a disadvantage in interpreting non-experimental data relative to economists. I have to trust Oster's read of the studies because I haven't looked through them myself, but it sounds like the issue of endogeneity is completely absent - particularly in some of the most widely cited studies. Again, this shouldn't be surprising. Medical research is principally experimental research, so when a future medical researcher is sitting through stats classes they're not going to spend all the time that economists do talking about endogeneity and model identification.

When you look at studies that do a better job dealing with this the results are less scary - moderate drinking and caffeine intake don't seem to have an identifiable impact.

The other thing she does that I like is that she tries to get a better sense of the probability distributions underlying the dos and don'ts. This is extremely frustrating around weight issues where I'd agree that a lot of doctors act like there is not a continuous distribution of expected weight gains - that if you're one pound over the expected gain it's a problem rather than a marginal increase in the context of a probability distribution with a high level of variability in the first place. I also liked her more detailed look at exactly what foods pose a listeria risk (nasty stuff that pregnant women are far more susceptible to and can cause blindness in the baby). Apparently deli turkey is a real problem for it... but deli ham is very low risk. You wouldn't know that from the doctors - they just tell you to stay away from all deli meats.

I do have to disagree with Oster and people who responded to her like Art Carden on one issue. Art writes: "Ms. Oster's essay speaks to modernity's outsized obsession with minor risks generated by a news cycle that is constantly warning us about monsters under the bed or in the coffee pot. Fretting about trivial risks is itself risky; it leaves us with less time and attention to deal with more substantial concerns."

When you're pregnant you have a lot on your mind and a lot to do in a short amount of time. I imagine this is particularly true of first-timers. Although as a data guy I do of course think it's good to know what's behind these dos and don'ts and make decisions accordingly, I also think there's a good reason for the more straightforward rules. Behavioral economics tells us that people use heuristics because we are working with limited cognitive resources. We have a lot on our plate, particularly those of us expecting a baby. Kate and I like wine a lot and Kate knows that a little wine is not going to be a problem for the baby, but she's refused to drink (and she has one cup of coffee a day) through the pregnancy because it's much easier to do that than it is to weigh all the competing risks and keep track of how much she drank this week. It's a heuristic. It lets her bracket off that whole issue, not think about it any more, and focus on navigating the nursery, work, the sequester, the doctors visits, and the pregnancy classes. It's a stress reducer. If she continued drinking she would constantly be second guessing any given decision to have a drink and she'd be miserable.

It would be nice if doctors could provide more detail on the data associated with all this but they have limited time too and I don't think they present the simple dos and don'ts to make people worry. Quite the opposite - they do it precisely so people don't have to fret over it.

First, this is another example (like Bob Murphy's discussion the other day of military suicides), where experimental scientists are often at a disadvantage in interpreting non-experimental data relative to economists. I have to trust Oster's read of the studies because I haven't looked through them myself, but it sounds like the issue of endogeneity is completely absent - particularly in some of the most widely cited studies. Again, this shouldn't be surprising. Medical research is principally experimental research, so when a future medical researcher is sitting through stats classes they're not going to spend all the time that economists do talking about endogeneity and model identification.

When you look at studies that do a better job dealing with this the results are less scary - moderate drinking and caffeine intake don't seem to have an identifiable impact.

The other thing she does that I like is that she tries to get a better sense of the probability distributions underlying the dos and don'ts. This is extremely frustrating around weight issues where I'd agree that a lot of doctors act like there is not a continuous distribution of expected weight gains - that if you're one pound over the expected gain it's a problem rather than a marginal increase in the context of a probability distribution with a high level of variability in the first place. I also liked her more detailed look at exactly what foods pose a listeria risk (nasty stuff that pregnant women are far more susceptible to and can cause blindness in the baby). Apparently deli turkey is a real problem for it... but deli ham is very low risk. You wouldn't know that from the doctors - they just tell you to stay away from all deli meats.

I do have to disagree with Oster and people who responded to her like Art Carden on one issue. Art writes: "Ms. Oster's essay speaks to modernity's outsized obsession with minor risks generated by a news cycle that is constantly warning us about monsters under the bed or in the coffee pot. Fretting about trivial risks is itself risky; it leaves us with less time and attention to deal with more substantial concerns."

When you're pregnant you have a lot on your mind and a lot to do in a short amount of time. I imagine this is particularly true of first-timers. Although as a data guy I do of course think it's good to know what's behind these dos and don'ts and make decisions accordingly, I also think there's a good reason for the more straightforward rules. Behavioral economics tells us that people use heuristics because we are working with limited cognitive resources. We have a lot on our plate, particularly those of us expecting a baby. Kate and I like wine a lot and Kate knows that a little wine is not going to be a problem for the baby, but she's refused to drink (and she has one cup of coffee a day) through the pregnancy because it's much easier to do that than it is to weigh all the competing risks and keep track of how much she drank this week. It's a heuristic. It lets her bracket off that whole issue, not think about it any more, and focus on navigating the nursery, work, the sequester, the doctors visits, and the pregnancy classes. It's a stress reducer. If she continued drinking she would constantly be second guessing any given decision to have a drink and she'd be miserable.

It would be nice if doctors could provide more detail on the data associated with all this but they have limited time too and I don't think they present the simple dos and don'ts to make people worry. Quite the opposite - they do it precisely so people don't have to fret over it.

Wednesday, August 14, 2013

Catalan on Hayek's liquidationism and MV stabilization

Here. He summarizes it in this way: "I frame Hayek's liquidationism as wanting to reorganize the pattern of trade, while MV stability is supposed to maintain the volume of trade."

The issue of course being that these two may be at cross-purposes.

And once again - stable MV offers the opportunity for modest counter-cyclicality, but it's still generally speaking a policy of deflation. "Good deflation" maybe, in the sense of it being a productivity norm, but that still can have bad implications in a macroeconomy with frictions. So even Hayek's "anti-liquidationism" is more liquidationist than what most people are talking about.

The issue of course being that these two may be at cross-purposes.

And once again - stable MV offers the opportunity for modest counter-cyclicality, but it's still generally speaking a policy of deflation. "Good deflation" maybe, in the sense of it being a productivity norm, but that still can have bad implications in a macroeconomy with frictions. So even Hayek's "anti-liquidationism" is more liquidationist than what most people are talking about.

Pete Boettke asks why ABCT isn't on top

Here. The answer to that is pretty complex. If I were to provide a full answer I'd probably reject a lot of his premises in the post too. I don't have time for a full answer write now but I did write up part of my answer on facebook, which I'm reproducing in full below:

I think a lot of it is path dependence in the science and it need not stay that way. Indulge me in a stylized history of thought as to what that path dependence consisted of... I promise I'll get back to ABCT by the end.

Keynes did a better job of explaining the depression so he came out of the 30s and 40s on top. There were informal microfoundations in Keynes and the same worries about microfoundations that Lucas would later express. This is true of Hayek too - there are informal microfoundations but nothing particularly formal in the presentation of ABCT (I've only read portions of Pure Theory of Capital... maybe there's a lot more in there but since Austrians even seem to get headaches from that book perhaps it hasn't been the best ambassador for ABCT).

When Lucas (and Phelps) pushed the microfoundations point Keynes was dominant so of course what got reformed was a microfounded Keynesianism which is essentially the consensus macro model today.

ABCT was not dominant when the Lucas critique came around so ABCT never got the formal microfoundations that modern economists expect of a theory. In that sense I'd kind of take the opposite view of yours in the post - even though there's informal discussion of microfoundations, it's the lack of microfoundations in ABCT that is it's major liability right now.

This need not be the case. ABCT explores a lot of interesting issues around the capital structure that no one else is really talking about. I'll have to take a look at the Calvo article and how it treats the problem.

Recently I wrote a post on what I think is the best way forward for modeling ABCT in a way that mainstream economists would find plausible.

In a nutshell, I think the Romer endogenous growth model is structurally the most similar to Hayek's. Currently in the Romer model there is no time component to intermediate goods. Adding a time component to tie in the interest rate to decisions in the intermediate good markets and then doing an analysis of the impact of interest rate changes should reproduce the essential elements in ABCT in a very highly regarded mainstream macro model.

I'd try it myself but it's tangential to my current dissertation plans.... maybe IHS can incentivize me with some money :)

One other probably much more obvious contributor is that Hayek dropped a lot of his macro work after the 40s. That SURELY made a dent in the success of ABCT. Imagine if Hansen and Samuelson and Tobin and Patinkin and Robinson all just said "oh well - I'll talk about macro from time to time but I'm going to do my really innovative work on other problems"... Keynesianism wouldn't be in very good shape.

Treating Keynesians like they don't understand basic economics probably hasn't helped ABCT's prospects either."

Assault of Thoughts - 8/14/2013

"Words ought to be a little wild, for they are the assault of thoughts on the unthinking" - JMK

- An economist from the Journal of Wine Economics discusses buying value wines with Food & Wine Magazine.

- Lester and Wolff's very well done empirical work on ABCT is apparently going to be published in the Review of Austrian Economics (it has been in working paper mode). This is one of several empirical analyses I discuss in the forthcoming Critical Review article.

- Bob Lerman discusses why more women aren't apprentices.

- A new IZA working paper suggests that male unemployment reduces domestic violence rates. The logic is that their outside options become less favorable, leading them to engage in behavior that is less threatening to the relationship. One (of a few) concerns I have about the paper is the high collinearity between male and female unemployment rates that might be driving the similar magnitudes/opposite sign result. It would be nice to perhaps run the two separately to see if similar results come up perhaps.

- An economist from the Journal of Wine Economics discusses buying value wines with Food & Wine Magazine.

- Lester and Wolff's very well done empirical work on ABCT is apparently going to be published in the Review of Austrian Economics (it has been in working paper mode). This is one of several empirical analyses I discuss in the forthcoming Critical Review article.

- Bob Lerman discusses why more women aren't apprentices.

- A new IZA working paper suggests that male unemployment reduces domestic violence rates. The logic is that their outside options become less favorable, leading them to engage in behavior that is less threatening to the relationship. One (of a few) concerns I have about the paper is the high collinearity between male and female unemployment rates that might be driving the similar magnitudes/opposite sign result. It would be nice to perhaps run the two separately to see if similar results come up perhaps.

Tuesday, August 13, 2013

One more point on stable MV

It's often presented as this ace in the hole against those dummies that think Hayek talked like a liquidationist, and it can be presented in that light because we're usually talking about the 1930s. Preserving MV in the 1930s meant expansionary monetary policy until we got to the 38/39/40 range. Ergo, not liquidationist.

But after the 1930s, stable MV is a far cry from what we usually think of as anti-liquidationism. You can call it "good deflation" if you want to, but it's not a stretch at all to say that an advocate of stable MV is an adamant opponent of monetary expansion in recessions.

When a really harsh depression comes along, stable-MV can turn semi-expansionary. But that's about it.

So stable-MV, though not "liquidationism" in the specific context of the Great Depression, is not some kind of market monetarist kissing-cousin either.

But after the 1930s, stable MV is a far cry from what we usually think of as anti-liquidationism. You can call it "good deflation" if you want to, but it's not a stretch at all to say that an advocate of stable MV is an adamant opponent of monetary expansion in recessions.

When a really harsh depression comes along, stable-MV can turn semi-expansionary. But that's about it.

So stable-MV, though not "liquidationism" in the specific context of the Great Depression, is not some kind of market monetarist kissing-cousin either.

Hayek said liquidationist things and he said stable nominal income things and the latter doesn't erase the former

Larry White has a very odd response up to Paul Krugman on Hayek.

For those of you that don't know about his JMCB article, White makes a great argument that Hayek said he wanted to stabilize MV in response to a piece by Brad DeLong. The trouble is, he also made alarmingly liquidationist statements. I hate this tendency to act like people are dummies because of Hayek's inconsistency or the tendency to act like because Hayek said X on Tuesday it means he didn't say Y on Friday. The latter absolutely does not follow from the former.

It's hard to get around this: "...if we pass from the moment of actual crisis to the situation in the following depression, it is still more difficult to see what lasting good effects can come from credit expansion."

That is not stabilizing MV. Krugman is quite right.

You see this with Road to Serfdom too, such that I've just developed the habit of tuning out of any posts about the book. Farrant and McPhail do a really masterful job on this one taking down the Caldwell/Boettke position by pointing out that - as with the MV stabilization/liquidationist issue - Hayek did indeed make strong slippery slope arguments sometimes and didn't at other times. The Caldwell/Boettke camp usually responds to this by pointing out the times that Hayek wasn't making the strong slippery slope arguments. But that doesn't disprove the point - that only demonstrates that Hayek was highly inconsistent!

Hayek lived a long life, people are allowed to change their minds, and people are also allowed to be careless with words sometimes. What bothers me is:

For those of you that don't know about his JMCB article, White makes a great argument that Hayek said he wanted to stabilize MV in response to a piece by Brad DeLong. The trouble is, he also made alarmingly liquidationist statements. I hate this tendency to act like people are dummies because of Hayek's inconsistency or the tendency to act like because Hayek said X on Tuesday it means he didn't say Y on Friday. The latter absolutely does not follow from the former.

It's hard to get around this: "...if we pass from the moment of actual crisis to the situation in the following depression, it is still more difficult to see what lasting good effects can come from credit expansion."

That is not stabilizing MV. Krugman is quite right.

You see this with Road to Serfdom too, such that I've just developed the habit of tuning out of any posts about the book. Farrant and McPhail do a really masterful job on this one taking down the Caldwell/Boettke position by pointing out that - as with the MV stabilization/liquidationist issue - Hayek did indeed make strong slippery slope arguments sometimes and didn't at other times. The Caldwell/Boettke camp usually responds to this by pointing out the times that Hayek wasn't making the strong slippery slope arguments. But that doesn't disprove the point - that only demonstrates that Hayek was highly inconsistent!

Hayek lived a long life, people are allowed to change their minds, and people are also allowed to be careless with words sometimes. What bothers me is:

1. Cases like Larry White treating Krugman like he's being intellectually lazy for pointing out that Hayek was clearly a promoter of liquidationism on many occasions, and

2. The failure to recognize that this seems to be a particularly common problem with Hayek. You wouldn't get liquidationism jumbled up together with anti-liquidationism in Keynes or Friedman, for example. But you do with Hayek, and it's a problem that seems to come up a lot. If we still can't agree on the message of the Road to Serfdom or if we still can't agree on the message of the interwar macro work, it seems to me the obvious conclusion is not that Krugman is a dummy - but that Hayek was all over the map. And it seems to me it's reasonable to assume he is culpable for being all over the map - i.e., to the extent that he was a liquidationist he was culpable for being a liquidationist and deserves to be called out on it.

Monday, August 12, 2013

Why I am still an optimistic free market Keynesian

Krugman and Sumner have been tossing around reactions to the policy failures associated with the crisis. There have been policy failures, but I don't understand why some people are such pessimists about it.

I'm an optimist because I can imagine as a very realistic prospect at least two other worlds:

Market monetarists tend to be very dismal either because they define success as adopting their particular policy instrument (rather than a particular monetary stance), or because they define the monetary stance according to macroeconomic outcomes and not relative to a plausible counter-factual policy. I have some sympathy with the latter - we're clearly "tight" now. But I have little sympathy with defining the policy stance itself by whether or not the desired outcome is achieved - this "do or do not, there is no try" crap. That makes for good movies but it's dumb practically speaking. We can definitely try things that fail and you know what - we've still tried that thing.

Keynesians are somewhat better on this count, so it's unfortunate that Krugman is such a downer about it. Keynesians have output gaps, Okun's law, and multiplier estimates that make it easier to avoid the Yoda garbage and just say "you know what - it could have been worse and at least we got a couple hundred billion in". Kind of like the New Deal in fact. It didn't do much, as we all know, but Americans still radiate with pride decades later over the work of the WPA and the CCC.

Interestingly enough the roles are switched here - Krugman is talking pessimistic and Sumner is talking optimistic. But generally speaking I find that market monetarists are more downers than the Keynesians because of the difference in how they define their goals (Keynesians also think market monetarists have it half right whereas market monetarists seem hell-bent on refusing to take "yes" for an answer from Keynesians on monetary policy).

This is also why I simply don't get the "public choice" argument (I have to put that in quotes for the sake of the dignity of public choice theory) against Keynesianism that says that if politicians are going to botch it up you are somehow obligated to abandon it. I think the actual world is better than the first scenario I described above even though I'd prefer to see the second scenario to both the actual world and the first scenario. It makes exactly zero sense to say that because there are policy failures out there and I can't trust politicians to implement Keynesianism perfectly that it's worthless enterprise. That's like saying because I won't be a completely perfect dad the most sensible thing to do is to never have kids in the first place. Nonsense.

It's very easy to lose perspective amidst the short-run disappointments, but in the big picture there's good reason to stay optimistic and at the very least recognize that it could have been worse and that it's a good thing it wasn't.

I'm an optimist because I can imagine as a very realistic prospect at least two other worlds:

1. A world where ARRA failed and QE was never tried - a really awful, awful world that could have happened but didn't, andOf course, we got the world we got, which carries frustrations with it but also could be worse.

2. A world where ARRA was twice as big and spent more wisely and where QE was bigger, had better forward guidance, and IOR was scrapped - a better world.

Market monetarists tend to be very dismal either because they define success as adopting their particular policy instrument (rather than a particular monetary stance), or because they define the monetary stance according to macroeconomic outcomes and not relative to a plausible counter-factual policy. I have some sympathy with the latter - we're clearly "tight" now. But I have little sympathy with defining the policy stance itself by whether or not the desired outcome is achieved - this "do or do not, there is no try" crap. That makes for good movies but it's dumb practically speaking. We can definitely try things that fail and you know what - we've still tried that thing.

Keynesians are somewhat better on this count, so it's unfortunate that Krugman is such a downer about it. Keynesians have output gaps, Okun's law, and multiplier estimates that make it easier to avoid the Yoda garbage and just say "you know what - it could have been worse and at least we got a couple hundred billion in". Kind of like the New Deal in fact. It didn't do much, as we all know, but Americans still radiate with pride decades later over the work of the WPA and the CCC.

Interestingly enough the roles are switched here - Krugman is talking pessimistic and Sumner is talking optimistic. But generally speaking I find that market monetarists are more downers than the Keynesians because of the difference in how they define their goals (Keynesians also think market monetarists have it half right whereas market monetarists seem hell-bent on refusing to take "yes" for an answer from Keynesians on monetary policy).

This is also why I simply don't get the "public choice" argument (I have to put that in quotes for the sake of the dignity of public choice theory) against Keynesianism that says that if politicians are going to botch it up you are somehow obligated to abandon it. I think the actual world is better than the first scenario I described above even though I'd prefer to see the second scenario to both the actual world and the first scenario. It makes exactly zero sense to say that because there are policy failures out there and I can't trust politicians to implement Keynesianism perfectly that it's worthless enterprise. That's like saying because I won't be a completely perfect dad the most sensible thing to do is to never have kids in the first place. Nonsense.

It's very easy to lose perspective amidst the short-run disappointments, but in the big picture there's good reason to stay optimistic and at the very least recognize that it could have been worse and that it's a good thing it wasn't.

We're going to cut this umbilical cord with Marshallian scissors

Kate had her baby shower on Saturday. This was the only just-for-dad-and-daughter gift, from a good friend:

Catalan on Keynes and Hayek, or Intellectual History via Pithy Statements

A good post here. I too have always found the idea that Keynes's response was beyond the pale because it talked about Hayek's book very odd.

I think sometimes these one-liners develop because of famous specific pithy treatments of them.

- We all cite Hicks when we say Hayek was Keynes's main rival

- We all cite Kaldor when we say Hayek was out of his depths in the seminar

- We all cite Pigou when we say Keynes was awful to Hayek in his response

- We all cite Harrod when we say that Keynes was some kind of modern Plato that thought philosopher kings could run everything

- We all cite Hayek when we say that Hayek didn't respond to the General Theory because Keynes was so damn fickle

- We all cite Samuelson when we say that no one had a clue what Keynes was talking about

Some of these pithy treatments are stronger than others obviously. All of them come many, many years after the original events. What's unfortunate is that I think a lot of peoples' sense of intellectual history seems to come from taking each of these for granted. It gets so bad sometimes that one can get denounced (often without any kind of evidence for the purpose of actual persuasion) for even asking if we have good reason to believe one of these pithy statements - even if it's one of the pithy statements one is predisposed to agree with in broad stokes!

UPDATE: For the record I think Hicks is mostly right but probably an overstatement, Kaldor is probably relating a true event and somewhat right but overstating the extent to which it was a debacle, Pigou is wrong (and almost makes me wonder if he had seen an early draft of Keynes's General Theory and was just projecting himself on Hayek), Harrod is wrong (unless you read him just to be saying that Keynes was an elitist - which is right - but that is not how it's usually taken), Hayek is wrong, and Samuelson is wrong except perhaps for some people thoroughly unfamiliar with economics at Cambridge. These are just impressions from my reading of the thinkers, the issues, and the period. I'm not an expert, but I'm pretty decently well read and respectably published for an early career economist.

I think sometimes these one-liners develop because of famous specific pithy treatments of them.

- We all cite Hicks when we say Hayek was Keynes's main rival

- We all cite Kaldor when we say Hayek was out of his depths in the seminar

- We all cite Pigou when we say Keynes was awful to Hayek in his response

- We all cite Harrod when we say that Keynes was some kind of modern Plato that thought philosopher kings could run everything

- We all cite Hayek when we say that Hayek didn't respond to the General Theory because Keynes was so damn fickle

- We all cite Samuelson when we say that no one had a clue what Keynes was talking about

Some of these pithy treatments are stronger than others obviously. All of them come many, many years after the original events. What's unfortunate is that I think a lot of peoples' sense of intellectual history seems to come from taking each of these for granted. It gets so bad sometimes that one can get denounced (often without any kind of evidence for the purpose of actual persuasion) for even asking if we have good reason to believe one of these pithy statements - even if it's one of the pithy statements one is predisposed to agree with in broad stokes!

UPDATE: For the record I think Hicks is mostly right but probably an overstatement, Kaldor is probably relating a true event and somewhat right but overstating the extent to which it was a debacle, Pigou is wrong (and almost makes me wonder if he had seen an early draft of Keynes's General Theory and was just projecting himself on Hayek), Harrod is wrong (unless you read him just to be saying that Keynes was an elitist - which is right - but that is not how it's usually taken), Hayek is wrong, and Samuelson is wrong except perhaps for some people thoroughly unfamiliar with economics at Cambridge. These are just impressions from my reading of the thinkers, the issues, and the period. I'm not an expert, but I'm pretty decently well read and respectably published for an early career economist.

I would like all this work and class and dissertation and baby stuff to just go away...

...so I could write about Keynes again.

OK?

Thanks.

OK?

Thanks.

Quote of the day

From Ryan Murphy:

"Partisanship is just so damn boring. Cheerleading for Krugman (or against) is a half step away from cheerleading for John Cena. And like with cheerleading for John Cena, it’s far more interesting to conduct bizarre meta analyses of it than to actually partake in it."And here's the other thing about this kind of partisanship: it's stupid when there's a lot of good content because you could be talking about the content. But when there's not content why would you waste any of your time being especially partisan.

Sunday, August 11, 2013

Hayek did matter

Some interesting points have been raised, particularly in the area of citation counts (which is probably the clearest way to make the case). Ryan Murphy recalled that he was the third most cited economist in the 1930s after Keynes and Robertson.

Kevin Donoghue has the evidence on that one:

Kevin Donoghue has the evidence on that one:

"That's Snowdon & Vane, referring to the years 1931-35. Original source they cite is Deutscher, "RG Hawtrey & the Development of Macroeconomics."

But 1931-35 was Hayek's peak as a macro man. In 1920-30 he failed to make the top 10 (Keynes squeaked in at 10th). In 1936-39 Hayek was joint 7th, trailing Keynes, Robertson, Hicks, Pigou, Harrod and Hawtrey. In 1940-44 he again dropped out of the top 10."Tyler Cowen also notes Alvin Hansen's assessment of Hayek's importance in real time - which I consider to be much more valuable an indicator than Hicks's statements decades later. Hansen of course was not predisposed to attribute much value to Hayek's work since he is generally associated with secular stagnation and long-wave type ideas about the business cycle.

I'd like to see Kim Kardashian blog about the difference between Old and New Keynesian IS curves

Nice post.

And how cool is it that this is on the New York Times website? This is what good econ blogging it - presenting these ideas that would otherwise just be tossed around among economists and presenting it to a more general audience. Much better than the navel-gazing you often get.

And how cool is it that this is on the New York Times website? This is what good econ blogging it - presenting these ideas that would otherwise just be tossed around among economists and presenting it to a more general audience. Much better than the navel-gazing you often get.

Friday, August 9, 2013

Did Hayek matter?

Jonathan Catalan picks up on a line in Krugman's post that I thought was interesting but didn't comment on. Krugman wrote:

The more I think about it the idea that the Keynes/Hayek rivalry was a major rivalry seems to come from two sources: (1.) the claims of lots Austrians in the last quarter of the 20th century and the beginning of the 21st, and (2.) John Hicks towards the end of his life.

What I am not aware of (maybe it's out there) is John Hicks saying in the 1930s how important Hayek's view was.

Jonathan writes: "Otherwise, Keynes wouldn't have drafted Sraffa into his debate with Hayek, and Hayek wouldn't have received so much attention from Kaldor, Hicks, Knight, Pigou, et cetera (yes, the list does go on)."

I don't know if this quite does it. You'd think if it was that critical an opponent Keynes would have done the job himself. He did write a review of a Federal Reserve document in the same issue of the Economic Journal and he wrote in it often about topics that consumed him. Why is it always said that because Keynes thought Hayek was important to respond to that he assigned the task to Sraffa? Sraffa had the experience talking about Hayek's theory over lunch with Keynes and Wittgenstein. Perhaps Keynes asked him because he knew they were on the same page and he didn't think it was worth his own time to deal with.

This is all just an open question. Obviously Hayek was a good economist that people respected. But I didn't realize until reading Jonathan's post how much I just took for granted that Hayek's contribution was considered important at the time rather than simply being dressed up as such after the fact.

Is there any evidence of this that:

1. Doesn't come from a Hayek booster?, and

2. Doesn't come several decades later?

Did anyone associated with Cambridge in the 30s make the sorts of assertions about Hayek's importance that Hicks was to later?

I feel like we invent a lot of these stories after the fact and I'm just curious if we have a good reason to.

"Or think about the economics rap video of Keynes versus Hayek everyone had fun with. Never mind that back in the 30s nobody except Hayek would have considered his views a serious rival to those of Keynes; the real shock should be, what happened to Friedman?"Jonathan doesn't like this claim, and my prior has been to disagree with it too... but...

The more I think about it the idea that the Keynes/Hayek rivalry was a major rivalry seems to come from two sources: (1.) the claims of lots Austrians in the last quarter of the 20th century and the beginning of the 21st, and (2.) John Hicks towards the end of his life.

What I am not aware of (maybe it's out there) is John Hicks saying in the 1930s how important Hayek's view was.

Jonathan writes: "Otherwise, Keynes wouldn't have drafted Sraffa into his debate with Hayek, and Hayek wouldn't have received so much attention from Kaldor, Hicks, Knight, Pigou, et cetera (yes, the list does go on)."

I don't know if this quite does it. You'd think if it was that critical an opponent Keynes would have done the job himself. He did write a review of a Federal Reserve document in the same issue of the Economic Journal and he wrote in it often about topics that consumed him. Why is it always said that because Keynes thought Hayek was important to respond to that he assigned the task to Sraffa? Sraffa had the experience talking about Hayek's theory over lunch with Keynes and Wittgenstein. Perhaps Keynes asked him because he knew they were on the same page and he didn't think it was worth his own time to deal with.

This is all just an open question. Obviously Hayek was a good economist that people respected. But I didn't realize until reading Jonathan's post how much I just took for granted that Hayek's contribution was considered important at the time rather than simply being dressed up as such after the fact.

Is there any evidence of this that:

1. Doesn't come from a Hayek booster?, and

2. Doesn't come several decades later?

Did anyone associated with Cambridge in the 30s make the sorts of assertions about Hayek's importance that Hicks was to later?

I feel like we invent a lot of these stories after the fact and I'm just curious if we have a good reason to.

So much awesome Krugman lately

- On Milton Friedman. I thought this point about Friedman not being important to the history of economic thought was dumb, though - but most of the post is taken up with how unfortunate it is that the right doesn't seem to be paying much attention to him on practical matters.

- So I felt much better when he wrote this follow up post on Friedman that insisted he wasn't Friedman bashing and drove home what I thought was the main point of the first post anyway - that a lot of the right isn't paying attention to him.

- Krugman talking Kalecki. AWESOME. The paper he cites is nice as a political economy/public choice piece. Of course you don't get the full sweep of Kaleckian economics from that but it's easily his best known contribution among mainstream economists.

- Krugman on how Martin Luther King has become cuddly and what that means.

- Krugman on what people know about policy and how that affects policy.

Recently Pete Boettke promoted Hazlitt as a public intellectual and mocked the idea that Krugman was. On the former claim, I'm willing to hear arguments. As I've said what little I've read of Hazlitt doesn't speak well of him... but then again I'm the first to admit I've only read a little. It's not just that I disagree with him. There are lots of nice public intellectuals that I disagree with. It's that he didn't seem to have a clue what he was talking about. On the latter claim - get real Pete.

- So I felt much better when he wrote this follow up post on Friedman that insisted he wasn't Friedman bashing and drove home what I thought was the main point of the first post anyway - that a lot of the right isn't paying attention to him.

- Krugman talking Kalecki. AWESOME. The paper he cites is nice as a political economy/public choice piece. Of course you don't get the full sweep of Kaleckian economics from that but it's easily his best known contribution among mainstream economists.

- Krugman on how Martin Luther King has become cuddly and what that means.

- Krugman on what people know about policy and how that affects policy.

Recently Pete Boettke promoted Hazlitt as a public intellectual and mocked the idea that Krugman was. On the former claim, I'm willing to hear arguments. As I've said what little I've read of Hazlitt doesn't speak well of him... but then again I'm the first to admit I've only read a little. It's not just that I disagree with him. There are lots of nice public intellectuals that I disagree with. It's that he didn't seem to have a clue what he was talking about. On the latter claim - get real Pete.

how would you frame...

...really sensible, but small, coefficients and awful pseudo R2s?

I'm not going to try to shy away from anything here. The results match very well to theory, they just don't matter all that much. My discussion says that theory seems to explain behavior on the margin well but there area lot of non-economic contributors to this outcome that make it's ultimate magnitude insignificant.

It's more significant for some of the models, but the ones I care about less.

So I want to be honest but I just want to make sure I'm not still being too generous to my own biases.

Statistical significance is not a problem in any of these cases.

I'm not going to try to shy away from anything here. The results match very well to theory, they just don't matter all that much. My discussion says that theory seems to explain behavior on the margin well but there area lot of non-economic contributors to this outcome that make it's ultimate magnitude insignificant.

It's more significant for some of the models, but the ones I care about less.

So I want to be honest but I just want to make sure I'm not still being too generous to my own biases.

Statistical significance is not a problem in any of these cases.

Wednesday, August 7, 2013

New Acquisitions

A new year and a changing chair means office shake-ups, which means free books. I've acquired:

1. Eric Roll, History of Economic Thought - 4th edition (I believe there are five now). I hadn't heard of him but it looks comprehensive and well written.

2. Mas-Colell. I was a little disappointed not to have used this in Micro I. I believe they use it in Micro II, though, which I'll be taking in the spring. A free one is nice to have!

3. Robert Lucas - Studies in Business Cycle Theory. It's just an MIT Press collection of all his major contributions. Sometimes it's nice to have it all in one place.

I think there's an old NBER conference volume on public finance I think I might pick up too... they're just handsome old books that always seem nice to have.